Incoterms

Incoterms (International Commercial Terms) are a set of 11 standardized trade rules published by the International Chamber of Commerce (ICC) that define the responsibilities of buyers and sellers in international transactions. They determine who pays for shipping, insurance, and duties, and at what point the risk of loss transfers from seller to buyer. The current edition — Incoterms® 2020 — took effect on January 1, 2020.

Correct use of Incoterms prevents disputes and ensures all parties understand their obligations from factory floor to final destination.

What Are Incoterms

The ICC first published Incoterms in 1936 to address confusion over trade terms that varied by country and language. They have been revised approximately every ten years, with the current Incoterms® 2020 edition being the ninth revision.

Key Principles

- Incoterms are not law — They are contractual terms that must be explicitly incorporated into the sales contract (e.g., "FOB Shanghai, Incoterms® 2020")

- They define three things: (1) division of costs, (2) point of risk transfer, and (3) responsibility for tasks (transport, insurance, customs)

- They do not define: transfer of ownership/title, payment terms, or consequences of breach

- Each rule specifies 10 seller obligations (A1–A10) and 10 corresponding buyer obligations (B1–B10)

The Two Groups

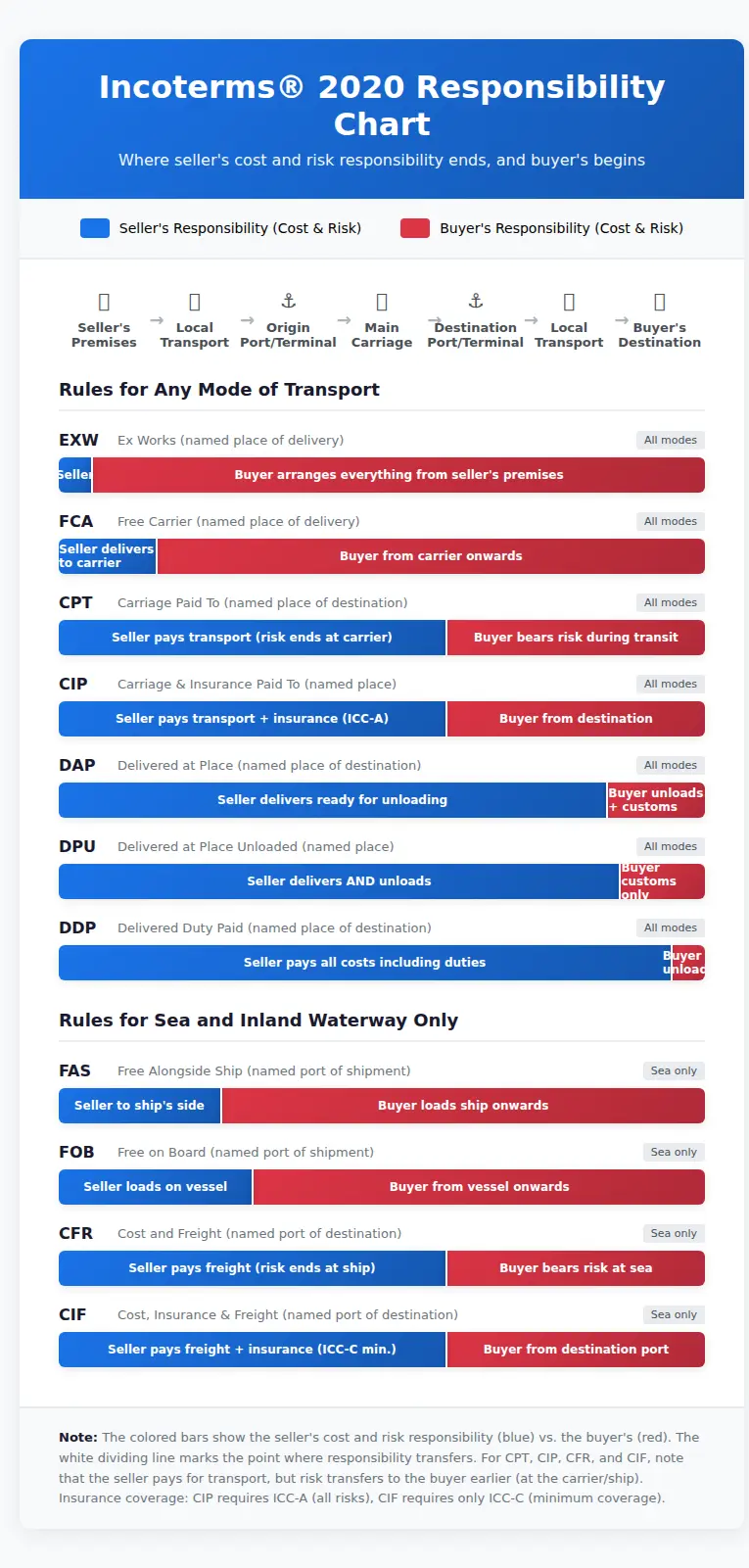

Incoterms 2020 divides the 11 rules into two groups based on mode of transport:

| Group | Rules | Applicable To |

|---|---|---|

| Rules for any mode of transport | EXW, FCA, CPT, CIP, DAP, DPU, DDP | Road, rail, air, ocean, or multimodal |

| Rules for sea and inland waterway only | FAS, FOB, CFR, CIF | Ocean and river transport exclusively |

FOB, CFR, and CIF should only be used for ocean/waterway shipments where goods are loaded onto a vessel. For containerized cargo (which is delivered to a terminal, not directly onto a ship), FCA, CPT, or CIP are technically more appropriate — though FOB remains widely used by convention.

Common Incoterms Explained

EXW — Ex Works (Named Place of Delivery)

The seller's obligation is minimal: make the goods available at their premises. The buyer bears all costs and risks from that point, including export clearance, loading, transport, and import duties.

EXW is often misused in international trade. It places the burden of export formalities on the buyer — who may be a foreign entity without the legal standing to clear goods for export in the seller's country. FCA is usually a better alternative.

FCA — Free Carrier (Named Place of Delivery)

The seller delivers goods to a carrier or nominated place. If delivery is at the seller's premises, the seller loads the goods. If delivery is elsewhere (e.g., a terminal), the seller's obligation ends when the goods arrive at that place, ready for unloading.

Key change in Incoterms 2020: Under FCA, the buyer can instruct their carrier to issue an on-board Bill of Lading to the seller — solving a long-standing practical problem in L/C transactions.

FOB — Free on Board (Named Port of Shipment)

The seller delivers goods on board the vessel at the named port. Risk passes to the buyer once the goods are on the ship. The seller handles export clearance. The buyer arranges and pays for ocean freight and insurance.

FOB is the most commonly used Incoterm for ocean freight worldwide.

CFR — Cost and Freight (Named Port of Destination)

Same as FOB for risk transfer (risk passes when goods are on board at origin), but the seller pays the ocean freight to the named destination port. The buyer bears risk during transit despite not arranging transport.

CIF — Cost, Insurance, and Freight (Named Port of Destination)

Same as CFR, plus the seller must procure marine cargo insurance covering the buyer's risk during transit. Under Incoterms 2020, the minimum coverage is Institute Cargo Clauses (C) — the most basic level.

CIF requires only minimum insurance coverage (ICC clause C). If you need broader protection, negotiate Institute Cargo Clauses (A) — "all risks" coverage — in your sales contract, or arrange your own policy.

DAP — Delivered at Place (Named Place of Destination)

The seller delivers goods to the named destination, ready for unloading. The seller bears all transport costs and risks to the destination. The buyer is responsible for unloading, import clearance, and duties.

DPU — Delivered at Place Unloaded (Named Place of Destination)

The only Incoterm where the seller is responsible for unloading at destination. Risk transfers once goods are unloaded at the named place. Replaced DAT (Delivered at Terminal) in Incoterms 2020.

DDP — Delivered Duty Paid (Named Place of Destination)

Maximum seller obligation. The seller delivers goods to the named destination, cleared for import, with all duties and taxes paid. The buyer's only responsibility is to unload the goods.

DDP requires the seller to handle import customs clearance in the buyer's country. This can be complex and expensive. Sellers should ensure they can legally act as importer of record and understand the destination country's regulatory requirements before agreeing to DDP.

Choosing the Right Incoterm

Selecting an Incoterm depends on several factors:

| Factor | Recommendation |

|---|---|

| Seller's logistics experience | Experienced sellers can manage more obligations (CIF, DAP, DDP) |

| Buyer's local knowledge | Buyers with strong destination logistics prefer FOB/FCA (they control transport) |

| Insurance needs | If the buyer wants to control insurance, use FOB/FCA; if the seller should arrange it, use CIF/CIP |

| Letter of credit requirements | L/C transactions often specify FOB or CIF to align with banking practices |

| Cargo value and risk tolerance | High-value cargo — consider CIP/CIF with enhanced coverage, or DAP/DDP for full seller control |

| Regulatory complexity at destination | If import clearance is complex, buyer should handle (FOB, CFR, CIF); otherwise DDP |

Incoterms and Cost Allocation

The following table shows which party bears each cost category under the most commonly used Incoterms:

| Cost Element | EXW | FCA | FOB | CFR | CIF | DAP | DDP |

|---|---|---|---|---|---|---|---|

| Export packing | Seller | Seller | Seller | Seller | Seller | Seller | Seller |

| Loading at origin | Buyer | Seller* | Seller | Seller | Seller | Seller | Seller |

| Export clearance | Buyer | Seller | Seller | Seller | Seller | Seller | Seller |

| Origin terminal charges | Buyer | Varies | Seller | Seller | Seller | Seller | Seller |

| Ocean freight | Buyer | Buyer | Buyer | Seller | Seller | Seller | Seller |

| Cargo insurance | Buyer | Buyer | Buyer | Buyer | Seller | Buyer | Seller |

| Destination terminal charges | Buyer | Buyer | Buyer | Buyer | Buyer | Seller | Seller |

| Import clearance | Buyer | Buyer | Buyer | Buyer | Buyer | Buyer | Seller |

| Import duties/taxes | Buyer | Buyer | Buyer | Buyer | Buyer | Buyer | Seller |

| Delivery to destination | Buyer | Buyer | Buyer | Buyer | Buyer | Seller | Seller |

*Under FCA, loading is the seller's responsibility only when delivery occurs at the seller's premises.

Incoterms 2020 Updates

The Incoterms® 2020 revision, effective January 1, 2020, introduced several notable changes from the 2010 edition:

Key Changes

-

DAT replaced by DPU — "Delivered at Terminal" (DAT) was renamed to "Delivered at Place Unloaded" (DPU) to clarify that delivery can occur at any named place, not just a terminal.

-

Different insurance levels for CIF vs CIP — CIF retains the minimum Institute Cargo Clauses (C); CIP now requires the higher Institute Cargo Clauses (A) — "all risks" coverage — as the default.

-

FCA and Bills of Lading — A new option allows the buyer to instruct their carrier to issue an on-board B/L to the seller after loading, addressing a common need in L/C transactions.

-

Own-means transport — FCA, DAP, DPU, and DDP now explicitly allow the seller or buyer to arrange transport using their own vehicles, not just third-party carriers.

-

Security-related obligations — Enhanced provisions for transport security requirements (e.g., container scanning, customs security filings).

-

Reorganized explanatory notes — Each rule's guidance was restructured for clarity, with improved user notes.

The ICC does not mandate updating existing contracts to the latest edition. Contracts referencing "Incoterms® 2010" remain valid. However, new contracts should specify "Incoterms® 2020" to benefit from the latest clarifications.

Related Articles

- Bill of Lading — B/L freight terms (Prepaid/Collect) align with the chosen Incoterm

- Ocean Freight Rates — How Incoterms determine who negotiates and pays freight rates

- Import/Export Documentation — Documentation responsibilities vary by Incoterm

- Role of a Freight Forwarder — Forwarders help execute obligations under the agreed Incoterm

- Customs Bonds — Relevant for DDP shipments where the seller handles import clearance

Resources

| Resource | Description |

|---|---|

| ICC — Incoterms® 2020 | Official ICC page for the current Incoterms edition |

| U.S. International Trade Administration — Know Your Incoterms | U.S. government guide to Incoterms for exporters |

| ICC — Incoterms® Rules Overview | General introduction and resources from the ICC |

| U.S. Export.gov — Trade Finance Guide | Government resource covering trade terms and payment methods |

| UNCITRAL — Transport Law | UN Commission on International Trade Law — transport conventions context |