Bill of Lading

The Bill of Lading (B/L) is the single most important document in ocean shipping. It serves three critical functions simultaneously: as a receipt for goods shipped, as evidence of the contract of carriage, and as a document of title that controls who can claim the cargo at destination. Understanding the different types of Bills of Lading and their legal implications is essential for anyone involved in international trade.

What is a Bill of Lading

A Bill of Lading is a legal document issued by a carrier (or its agent) to a shipper when goods are received for transport. Its origins trace back centuries to maritime commerce, and it remains governed today by international conventions including the Hague-Visby Rules, the Hamburg Rules, and the newer Rotterdam Rules.

The B/L performs three simultaneous functions:

- Receipt of goods — It confirms that the carrier has received the described cargo in apparent good order and condition (unless otherwise noted).

- Contract of carriage — It evidences the terms and conditions under which the carrier agrees to transport the goods from origin to destination.

- Document of title — When issued in negotiable form, the holder of the original B/L has the right to claim the cargo at destination. This function enables goods to be bought and sold while still in transit.

The Bill of Lading is not the contract of carriage itself — it is evidence of the contract. The actual contract is formed when the carrier accepts the booking. However, the B/L's terms and conditions govern the relationship between the carrier and any third-party holder of the document.

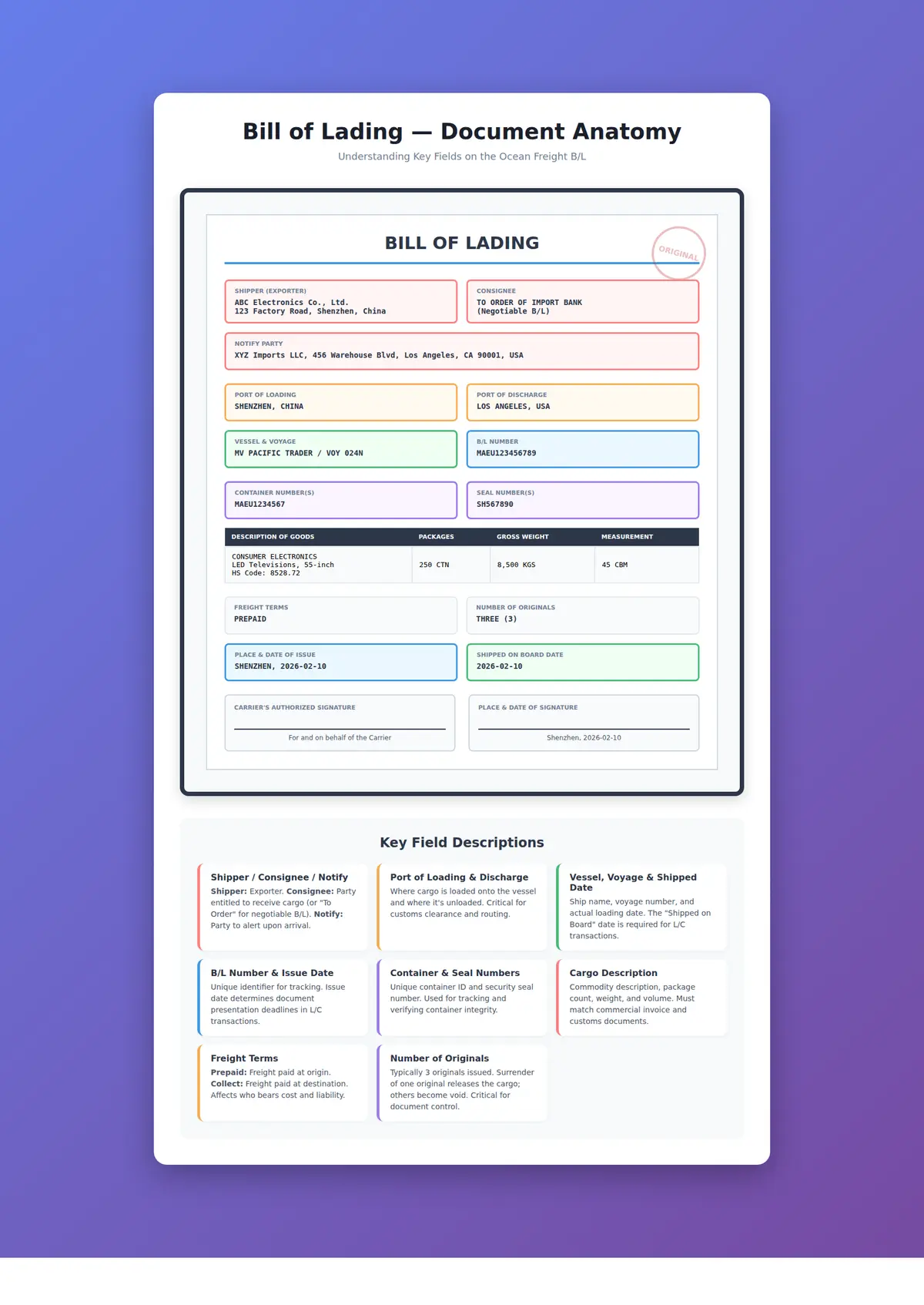

Anatomy of an ocean freight Bill of Lading showing all key fields. Color-coded sections highlight parties (red), routing (orange), vessel/dates (green/blue), and container details (purple).

Anatomy of an ocean freight Bill of Lading showing all key fields. Color-coded sections highlight parties (red), routing (orange), vessel/dates (green/blue), and container details (purple).

Types of Bills of Lading

Original Bill of Lading

The Original Bill of Lading is the traditional paper document, typically issued in a set of three originals (marked "First Original," "Second Original," "Third Original"). All three have equal legal standing — once one is presented to the carrier, the others become void.

Original B/Ls must be physically transported from the shipper to the consignee (or the consignee's bank in letter-of-credit transactions). The consignee must surrender at least one original to the carrier's agent at the destination port to take delivery of the cargo.

When to use an Original B/L:

- Letter of credit (L/C) transactions where banks require original documents

- Sales to unknown or untrusted buyers

- When the goods may be sold in transit

- High-value or sensitive shipments requiring maximum security

If original B/Ls are lost, obtaining cargo release can be extremely difficult and expensive. Carriers typically require a Letter of Indemnity backed by a bank guarantee — often for 100–200% of the cargo value — before releasing goods without originals.

Telex Release (Surrendered B/L)

A Telex Release is an electronic message from the carrier at the port of loading to the carrier's agent at the port of discharge, confirming that the original B/Ls have been surrendered at origin. The term "telex" is historical — today this communication happens via the carrier's electronic systems.

The process works as follows:

- The carrier issues the original B/L set

- The shipper returns ("surrenders") all originals to the carrier at the loading port

- The carrier sends an electronic release to the destination office

- The consignee collects cargo by presenting identification — no original documents needed

Advantages: Faster cargo release, no risk of documents being delayed or lost in transit. Disadvantages: Cannot be used with letter of credit transactions; the B/L loses its function as a document of title once surrendered.

Sea Waybill

A Sea Waybill (also called a Liner Waybill or Ocean Waybill) is a non-negotiable transport document. Unlike an original B/L, it is never a document of title — the named consignee can collect cargo simply by proving their identity.

Sea waybills are ideal for:

- Shipments between related companies (e.g., headquarters to subsidiary)

- Trusted trading relationships where title transfer is not required

- Short-sea routes where documents might arrive after the vessel

Sea waybills are increasingly popular in modern trade because they eliminate the risk of delayed documents and simplify the release process. If you do not need a negotiable document of title, a sea waybill is often the best choice.

Key Information on a B/L

Every Bill of Lading contains standard fields that are critical for customs clearance, cargo release, and commercial transactions:

| Field | Description |

|---|---|

| Shipper | The party sending the goods (exporter or their agent) |

| Consignee | The party entitled to receive the goods. May be a named party or "To Order" |

| Notify Party | The party to be notified upon cargo arrival (often the buyer or their agent) |

| Vessel & Voyage | The ship name and voyage number |

| Port of Loading | Where the cargo is loaded onto the vessel |

| Port of Discharge | Where the cargo is unloaded from the vessel |

| Place of Receipt | Inland origin point if carrier provides door pickup |

| Place of Delivery | Final delivery point if carrier provides door delivery |

| Container & Seal Numbers | Unique identifiers for tracking and security |

| Cargo Description | Commodity description, package count, weight, and volume |

| Freight Terms | Prepaid (paid at origin) or Collect (paid at destination) |

| Date of Issue | When the B/L was issued — critical for L/C compliance |

| "Shipped on Board" Date | Confirms when cargo was actually loaded on the vessel |

The distinction between "Received for Shipment" and "Shipped on Board" is important. A Shipped on Board B/L confirms the goods are physically on the vessel, while a Received for Shipment B/L only confirms the carrier has taken custody. Banks in L/C transactions almost always require a Shipped on Board B/L.

Negotiable vs Non-Negotiable

The negotiability of a B/L determines whether it functions as a document of title that can be transferred to third parties.

Negotiable (Order) B/L

A negotiable B/L is issued "To Order" or "To Order of [named party]." It can be transferred by endorsement — the current holder signs the back of the document, transferring rights to a new holder. This allows goods to be bought and sold while in transit, as each new holder gains title to the cargo.

Endorsement types:

- Blank endorsement — The holder signs without naming a transferee; the B/L becomes bearer paper (anyone holding it can claim the cargo)

- Special endorsement — The holder signs and names a specific transferee

- Restrictive endorsement — Limits further transfer (e.g., "For deposit only")

Non-Negotiable (Straight) B/L

A straight B/L names a specific consignee (e.g., "Consignee: ABC Imports Ltd."). It cannot be endorsed or transferred. Only the named consignee can take delivery. This is appropriate when there is no need to trade the goods in transit and the buyer is known and trusted.

| Feature | Negotiable B/L | Non-Negotiable B/L |

|---|---|---|

| Consignee field | "To Order" or "To Order of…" | Named consignee |

| Transferable | Yes, by endorsement | No |

| Document of title | Yes | Limited |

| Used with L/C | Yes (standard) | Rarely |

| Risk if lost | Very high | Moderate |

Role in Letter of Credit Transactions

In documentary credit (L/C) transactions, the Bill of Lading is the central document. The buyer's bank issues a letter of credit promising to pay the seller, provided the seller presents compliant documents — and the B/L is the most scrutinized among them.

Banks examine B/Ls under the rules of UCP 600 (Uniform Customs and Practice for Documentary Credits, published by the ICC). Key requirements include:

- The B/L must appear to be issued by the named carrier or their agent

- It must indicate that goods have been shipped on board the named vessel

- Loading and discharge ports must match the L/C terms

- The B/L must be presented within the document presentation period (typically 21 days after shipment, but no later than the L/C expiry)

- The consignee must match L/C instructions (usually "To Order of [issuing bank]")

Common discrepancies that cause bank rejections:

- Late presentation (B/L date vs. L/C deadline)

- Cargo description mismatch between B/L and L/C

- Missing "Shipped on Board" notation

- Port names not matching exactly

- Alterations without carrier authentication

B/L discrepancies are the leading cause of L/C payment delays. According to industry estimates, 60–70% of first-presentation L/C document sets contain discrepancies. Meticulous attention to detail when preparing B/L instructions is critical.

Related Articles

- Container Types — Understand the equipment referenced on Bills of Lading

- Incoterms — How trade terms determine who arranges shipping and B/L issuance

- Ocean Freight Rates — Freight terms on the B/L (Prepaid vs. Collect) link to rate agreements

- Import/Export Documentation — The B/L as part of the broader document set for customs clearance

- Documentation Flow — How the B/L moves through the freight forwarding process

Resources

| Resource | Description |

|---|---|

| ICC UCP 600 | Uniform Customs and Practice for Documentary Credits — governs B/L requirements in L/C transactions |

| Maersk: Sea Waybill vs Bill of Lading | Practical guide from the world's largest container carrier |

| U.S. CBP — Entry of Goods | U.S. Customs requirements for import documentation |

| UNCTAD Transport Law | United Nations overview of international transport law conventions |

| U.S. International Trade Administration — Know Your Incoterms | Government resource on trade terms related to B/L obligations |