Import/Export Documentation

International trade requires a comprehensive set of documents that serve multiple purposes: proving ownership, declaring value, demonstrating compliance with regulations, and enabling customs clearance. Missing, incomplete, or inaccurate documentation is one of the most common causes of shipment delays and penalties.

Understanding which documents are required, when they must be submitted, and how to complete them accurately is essential for any importer, exporter, or logistics professional.

Purpose of Trade Documentation

Trade documents fulfill several critical functions:

| Purpose | Description |

|---|---|

| Customs Clearance | Enable authorities to assess duties, taxes, and regulatory compliance |

| Payment | Support letters of credit, documentary collections, and payment verification |

| Title Transfer | Prove ownership and authorize release of goods to the consignee |

| Regulatory Compliance | Demonstrate adherence to import/export licenses, quotas, and sanctions |

| Insurance Claims | Provide evidence of value and condition if cargo is lost or damaged |

| Trade Statistics | Allow governments to track import/export volumes by product and country |

| Audit Trail | Create a paper trail for tax authorities, anti-dumping investigations, and compliance audits |

Assuming all countries require the same documents. While core documents like commercial invoices and packing lists are nearly universal, specific requirements vary by country, product type, and shipment value. Always verify destination country requirements before shipping.

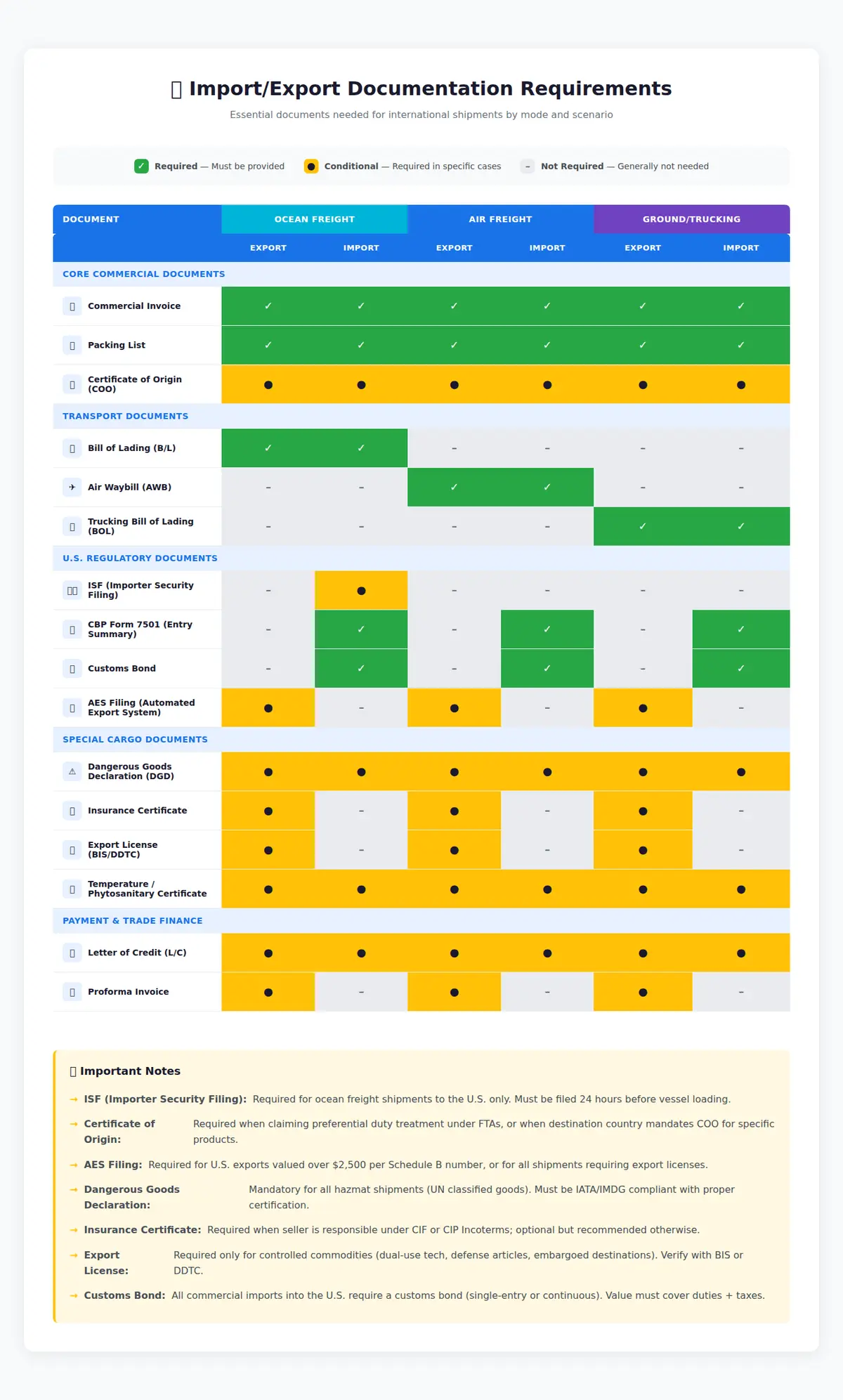

Document Requirements by Mode and Scenario

The following matrix shows which documents are required for different transportation modes and scenarios. Use this as a quick reference when preparing shipment documentation:

✓ = Required | ● = Conditional (depends on commodity, value, or FTA) | – = Not required

Key takeaways from the matrix:

- Commercial Invoice and Packing List are required for all international shipments regardless of mode

- ISF (Importer Security Filing) is specific to ocean imports into the U.S. and must be filed 24 hours before vessel loading

- Certificate of Origin becomes required when claiming preferential tariff treatment under Free Trade Agreements

- AES Filing is required for U.S. exports valued over $2,500 per commodity code

- Dangerous Goods Declaration is mandatory for all hazmat shipments across all modes

- Transport documents (B/L, AWB, BOL) are mode-specific and always required

Core Import/Export Documents

These documents are required for nearly all international shipments:

1. Commercial Invoice

The commercial invoice is the most important document in international trade. It serves as a bill for the goods sold and provides customs authorities with the information needed to assess duties and taxes.

Required Information

| Field | Description | Example |

|---|---|---|

| Seller (Exporter) | Company name, address, contact details | ABC Manufacturing, 123 Main St, Los Angeles, CA 90001, USA |

| Buyer (Importer) | Company name, address, contact details | XYZ Trading Ltd., 456 High Street, London, UK SW1A 1AA |

| Invoice Number & Date | Unique identifier and date of issuance | INV-2026-001234, February 10, 2026 |

| Terms of Sale (Incoterms) | Who pays for freight, insurance, and risk transfer point | FOB Los Angeles, CIF London |

| Payment Terms | When and how payment is due | Net 30 days, Letter of Credit at sight |

| HS Codes | Harmonized System classification for each product | 8703.23.00.50 |

| Product Description | Detailed description of each item | Passenger vehicle, gasoline engine, 4-door sedan, 2.5L |

| Quantity | Number of units | 50 units |

| Unit Price | Price per unit | $25,000.00 per unit |

| Total Value | Extended value (quantity × unit price) | $1,250,000.00 |

| Currency | Currency of the transaction | USD |

| Country of Origin | Where the goods were manufactured | United States of America |

| Freight & Insurance | Costs included or excluded depending on Incoterms | Freight: $15,000, Insurance: $3,000 (if CIF/CIP) |

| Total Invoice Value | Grand total including freight/insurance if applicable | $1,268,000.00 |

The commercial invoice value is used by customs to calculate duties and taxes. Understating value can result in penalties; overstating can lead to unnecessary duty payments.

Number of Copies

Typically, three copies are required:

- Copy 1: Sent to the buyer/importer

- Copy 2: Submitted to customs authorities

- Copy 3: Retained by the seller/exporter for records

Some countries require additional copies for banks, freight forwarders, or consulates.

2. Packing List

The packing list provides detailed information about the physical packaging of the shipment. It is used by customs, freight forwarders, and warehouse operators to identify and handle the cargo.

Key Information

| Field | Description |

|---|---|

| Shipper & Consignee | Same as commercial invoice |

| Invoice Reference | Links to the corresponding commercial invoice |

| Date of Shipment | When the goods left the origin facility |

| Package Count | Total number of packages (boxes, crates, pallets) |

| Package Type | Cartons, wooden crates, pallets, drums, etc. |

| Dimensions | Length × Width × Height for each package (cm or inches) |

| Gross Weight | Total weight including packaging (kg or lbs) |

| Net Weight | Weight of goods only, excluding packaging |

| Volume | Cubic meters (CBM) or cubic feet (CFT) |

| Marks & Numbers | Identifying labels or codes on packages |

| Product Description | What's inside each package (often matches invoice) |

Packing lists are non-commercial documents — they should not include prices or payment terms. Their purpose is purely logistical.

3. Bill of Lading (B/L) or Air Waybill (AWB)

The Bill of Lading (for ocean freight) or Air Waybill (for air freight) serves as a contract of carriage, receipt for goods, and document of title.

- Ocean Freight: See Bill of Lading for detailed information

- Air Freight: See Air Waybill for detailed information

4. Certificate of Origin (COO)

A Certificate of Origin certifies the country where the goods were manufactured or substantially transformed. It is required by many countries to:

- Determine eligibility for preferential tariff treatment under free trade agreements

- Enforce trade embargoes or sanctions

- Apply country-specific duties (e.g., anti-dumping or countervailing duties)

- Comply with government procurement regulations

Types of Certificates of Origin

| Type | Purpose | Issued By |

|---|---|---|

| Non-Preferential COO | General origin declaration for standard duty rates | Chamber of Commerce, trade association, or exporter self-certification |

| Preferential COO | Certifies eligibility for reduced/zero duties under FTA | Authorized government agency or exporter (depending on FTA rules) |

| Form A (GSP) | For developing countries exporting to developed countries under Generalized System of Preferences | Exporting country customs authority |

Key Information on a COO

- Exporter and consignee details

- Product description and HS code

- Country of origin

- Signature and stamp from issuing authority

- Date of issuance

Many modern FTAs (e.g., USMCA, CPTPP) allow exporter self-certification instead of requiring a government-issued COO. See Free Trade Agreements for more details.

5. Insurance Certificate or Policy

If the seller is responsible for insuring the cargo (as under CIF or CIP Incoterms), an insurance certificate or insurance policy must accompany the shipment.

Required Details

- Policy number and date

- Insured amount (typically 110% of CIF value)

- Description of goods

- Voyage details (vessel name, voyage number, or flight number)

- Coverage type (Institute Cargo Clauses A, B, or C)

- Beneficiary (usually the consignee or bank in L/C transactions)

Even when not required by Incoterms, cargo insurance is highly recommended. Ocean and air carriers have limited liability — often insufficient to cover full cargo value in case of loss or damage.

Country-Specific Import Documents

United States — Import Requirements

ISF (Importer Security Filing) — "10+2 Rule"

The Importer Security Filing (ISF) is a U.S. Customs and Border Protection (CBP) requirement for ocean freight shipments entering the United States.

Filing Deadline: ISF must be filed 24 hours before the cargo is loaded onto the vessel at the foreign port.

Who Files: The ISF Importer (usually the owner, purchaser, or consignee) or their authorized agent (freight forwarder or customs broker).

10 Data Elements (Importer's Responsibility):

- Seller (manufacturer/supplier name and address)

- Buyer (owner/consignee name and address)

- Importer of Record number (IRS/EIN/SSN)

- Consignee number (IRS/EIN/SSN)

- Ship-to party name and address

- Country of origin

- HS code (6-digit)

- Container stuffing location

- Consolidator name and address

- Stuffer name and address

+2 Data Elements (Carrier's Responsibility):

- Vessel stow plan

- Container status messages

Penalties: $5,000 per violation for late, incorrect, or missing ISF filings.

ISF must be filed before loading, not before arrival. Failure to file on time can result in cargo holds, examination fees, and penalties.

CBP Form 7501 — Entry Summary

The CBP Form 7501 (Entry Summary) is the official customs declaration used to clear goods into the United States. It must be filed by a licensed customs broker on behalf of the importer.

Key Information:

- Entry number, entry type, and entry date

- Importer of record details

- HS code and product description

- Customs value and duty calculation

- Country of origin

- Related party transaction disclosure

- AD/CVD case numbers (if applicable)

Filing Deadline: Within 10 days of cargo release (for consumption entries).

European Union — Import Requirements

Customs Declaration (SAD / Single Administrative Document)

The Single Administrative Document (SAD) is the standard customs form used for imports and exports in the EU. Since Brexit, the UK uses a similar form.

Key Sections:

- Box 1: Declaration type (IM = Import, EX = Export)

- Box 8: Consignee details

- Box 33: Commodity code (CN code, 8 digits)

- Box 42: Item price

- Box 47: Calculation of taxes (VAT, duties)

EORI Number

All importers and exporters in the EU must have an Economic Operators Registration and Identification (EORI) number.

Export Documentation

United States — Export Requirements

AES (Automated Export System) Filing

The AES (now called ACE Export Manifest) is the electronic export declaration required for shipments from the United States valued over $2,500 per Schedule B number or subject to export licensing.

Who Files: The U.S. Principal Party in Interest (USPPI) or their authorized agent (freight forwarder).

Information Required:

- Exporter details (EIN)

- Consignee details

- Schedule B number (10-digit export classification)

- Quantity, weight, and value

- Destination country

- Export license number (if applicable)

Filing Deadline: Before cargo is loaded onto the vessel or aircraft.

EIN (Employer Identification Number)

U.S. exporters must have an EIN from the IRS to file AES.

Export License

Certain products require an export license from the U.S. Department of Commerce (BIS) or Department of State (DDTC) due to:

- Dual-use technology (items with both civilian and military applications)

- Munitions and defense articles

- Encryption software

- Destination country restrictions (embargoes, sanctions)

License Types:

- EAR (Export Administration Regulations): Covers dual-use items (BIS jurisdiction)

- ITAR (International Traffic in Arms Regulations): Covers defense articles (DDTC jurisdiction)

Exporting controlled items without a license can result in severe penalties, including fines, imprisonment, and export privileges denial.

Document Flow in International Trade

Document Accuracy and Compliance

Common Documentation Errors

| Error | Consequence |

|---|---|

| Mismatched invoice and B/L descriptions | Customs hold, examination fees |

| Incorrect HS codes | Incorrect duty calculation, penalties |

| Missing or expired COO | Loss of preferential tariff treatment |

| Late ISF filing | $5,000 penalty, cargo hold |

| Undervalued commercial invoice | Fraud allegations, penalties, shipment seizure |

| Missing signatures on COO | Customs rejection, duty recalculation |

Best Practices

✅ Use consistent product descriptions across all documents (invoice, packing list, B/L)

✅ Verify HS codes with customs authorities or request a binding ruling

✅ File ISF early — don't wait until the 24-hour deadline

✅ Keep digital copies of all documents for 5+ years (IRS and CBP audit requirements)

✅ Use professional customs brokers for complex shipments

✅ Review destination country requirements before shipping — don't assume

CXTMS automates document generation and validation, flagging inconsistencies between invoices, packing lists, and shipping documents before submission to customs.

Digital Documentation Trends

The logistics industry is gradually moving toward paperless trade:

- Electronic Bills of Lading (eBL): Gaining acceptance under standards like DCSA and CMI Rules

- Digital Certificates of Origin: Some FTAs now accept electronic COOs

- Single Window Systems: Allow submission of all trade documents through one portal (e.g., ACE in the U.S., CHIEF/CDS in the UK)

- Blockchain-based Trade Platforms: Projects like TradeLens and IBM Food Trust enable secure, tamper-proof document sharing

However, most countries still require paper or PDF documents with original signatures for certain filings (especially COOs and L/C documents).

Resources

| Resource | Description | Link |

|---|---|---|

| Trade.gov Export Documentation Guide | U.S. government guide to export documents | trade.gov/common-export-documents |

| CBP ISF Information | Official ISF filing requirements and penalties | cbp.gov/isf |

| CBP Form 7501 Instructions | How to complete the U.S. Entry Summary | cbp.gov/form-7501 |

| ICC Commercial Invoice Template | International Chamber of Commerce standard invoice format | iccwbo.org |

| EU Customs Procedures | European Union customs documentation requirements | ec.europa.eu/taxation_customs |

Related Topics

- HS Codes — Product classification codes required on all customs documents

- Customs Bonds — Financial guarantee required for U.S. imports

- Free Trade Agreements — Preferential tariffs require proper COO documentation

- Bill of Lading — Key transport document for ocean freight

- Air Waybill — Key transport document for air freight

- Incoterms — Define which party is responsible for documents and insurance