Amazon Vulcan Is Rewriting Warehouse Economics: What 3PLs Must Do to Compete With Robot-Native Fulfillment

Amazon's Vulcan robot doesn't just see—it feels. And that single capability shift is about to redraw the competitive landscape for every third-party logistics provider in the industry.

What Vulcan Changes About Warehouse Robotics

In May 2025, Amazon unveiled Vulcan at its robotics facility in Dortmund, Germany—a dual-armed system equipped with force-torque sensors and suction-based grippers that give it what the company calls "a genuine sense of touch." Unlike previous warehouse robots that relied purely on computer vision, Vulcan can detect object weight, fragility, and grip stability in real time, allowing it to pick and stow items with far greater precision than its predecessors.

The system consolidates what previously required three separate robotic stations—picking, stowing, and consolidating—into a single workspace. Amazon confirmed plans to expand Vulcan deployment across additional U.S. and German fulfillment centers throughout 2026, signaling that this isn't a pilot. It's infrastructure.

The Automation Gap Is Becoming a Chasm

Amazon now operates over 750,000 robots across its global fulfillment network, alongside more than 1.5 million human workers. The company's robotic fleet includes Sequoia for inventory management, Sparrow for item-level picking, Robin and Cardinal for package sorting, and now Vulcan for tactile manipulation. Each generation solves a previously manual bottleneck.

Most 3PLs don't have a single one of these capabilities.

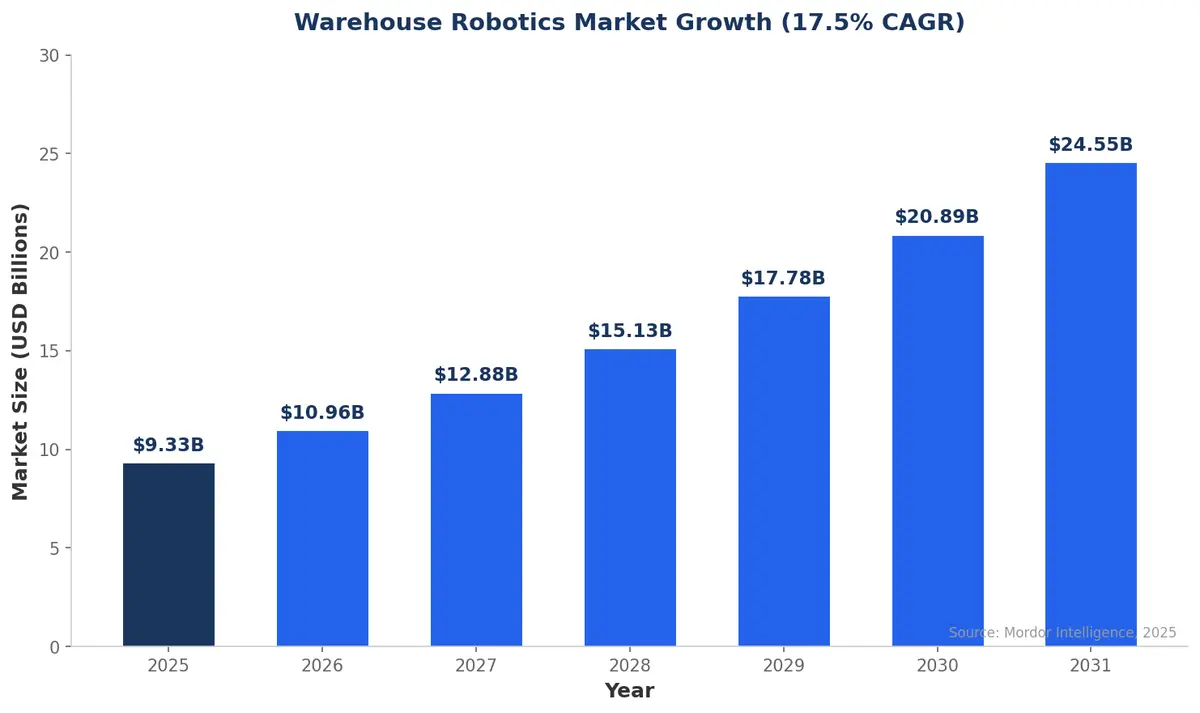

The warehouse robotics market is projected to grow from $9.33 billion in 2025 to $24.55 billion by 2031, expanding at a 17.5% CAGR.

But that growth is heavily concentrated among the largest operators. According to the Material Handling Institute, 79% of warehouses plan to deploy some form of robotics by 2026—yet for many mid-market 3PLs, "deployment" still means a single AMR pilot in one facility, not the integrated robotic ecosystem Amazon is building.

But that growth is heavily concentrated among the largest operators. According to the Material Handling Institute, 79% of warehouses plan to deploy some form of robotics by 2026—yet for many mid-market 3PLs, "deployment" still means a single AMR pilot in one facility, not the integrated robotic ecosystem Amazon is building.

The broader digital supply chain and logistics technology market tells the same story: valued at $72 billion in 2025, it's expected to reach $146.9 billion by 2031 at a 12.6% CAGR. The operators capturing that growth are the ones investing now, not waiting for costs to come down.

Why This Threatens Every 3PL's Business Model

Amazon's robotics advantage compounds across three dimensions that traditional 3PLs struggle to match:

Throughput density. Vulcan's consolidated workspace means Amazon can process more orders per square foot. When a single robotic cell replaces three manual stations, the real estate math changes fundamentally. For 3PLs leasing warehouse space at $8–12 per square foot in major markets, that density gap translates directly to cost-per-unit disadvantage.

Error rates. Tactile sensing reduces mispicks and damage. Amazon's robotic stowing systems already achieve error rates below 1%, compared to the 1–3% industry average for manual operations. Over millions of daily shipments, that difference is worth hundreds of millions annually.

Labor insulation. With warehouse labor turnover still exceeding 40% annually across the industry, Amazon's ability to shift repetitive tasks to robots provides structural cost predictability that labor-dependent 3PLs simply cannot offer.

Three Strategic Options for 3PLs

The 3PL market is expected to surpass $1.75 trillion globally by 2026. That's an enormous addressable market—but surviving in it requires a deliberate automation strategy. Here are three viable paths:

1. Build: Invest in Robotics Infrastructure

Large 3PLs with capital access can deploy goods-to-person systems, AMRs, and robotic picking arms across their networks. The ROI is increasingly proven: warehouse robotics deployments typically achieve payback within 18–24 months through labor savings and throughput gains. But the upfront investment—often $5–15 million per facility—excludes most mid-market operators.

2. Partner: Robotics-as-a-Service (RaaS)

The RaaS model lets 3PLs access robotic capabilities without massive capital expenditure. Providers like Locus Robotics, 6 River Systems, and others offer per-unit or per-pick pricing that scales with volume. This democratizes access to automation but creates dependency on external technology partners.

3. Specialize: Win Where Robots Can't

Not every fulfillment challenge is suited to robotics. Complex kitting, high-value goods requiring human judgment, regulated industries with specific handling requirements—these niches resist automation. 3PLs that build deep expertise in verticals Amazon won't prioritize can maintain defensible margins even without matching Amazon's robotic density.

What Mid-Market Shippers Should Demand

If you're a shipper evaluating 3PL partners, the automation question is no longer optional. Here's what to assess:

- Automation roadmap: Does your 3PL have a documented plan for robotics deployment over the next 24 months?

- Technology integration: Can their warehouse management system communicate with robotic systems and your TMS in real time?

- Performance benchmarks: What are their current pick accuracy rates, and how do they compare to automated benchmarks?

- Scalability: Can they handle volume surges without proportional labor increases?

The change management challenge is real—deploying robots is only half the battle. The other half is integrating robotic workflows with existing WMS, TMS, and ERP systems so that automation actually delivers end-to-end efficiency rather than creating new data silos.

How CXTMS Connects the Automated Warehouse

Robot-native fulfillment only delivers its full potential when warehouse execution data flows seamlessly into transportation management. CXTMS bridges that gap by integrating warehouse automation outputs—order completion signals, inventory updates, and shipping-ready notifications—directly into transportation planning and carrier selection workflows.

Whether your 3PL runs Vulcan-level robotics or a single AMR fleet, CXTMS ensures that warehouse throughput translates into optimized shipping execution, not bottlenecked handoffs.

Evaluating how warehouse automation fits your logistics strategy? Contact CXTMS for a demo of how our TMS integrates with automated fulfillment environments.