CBAM Goes Live: How the EU Carbon Border Tax Is Reshaping Logistics Costs for Global Shippers in 2026

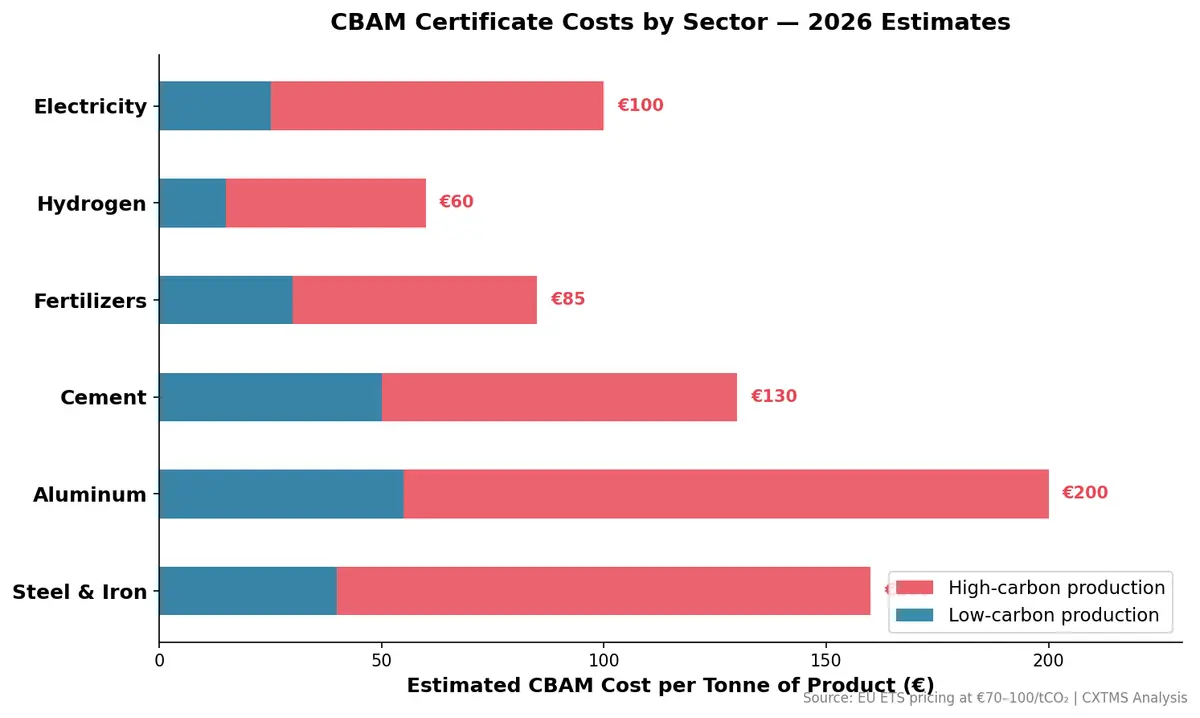

The EU's Carbon Border Adjustment Mechanism — better known as CBAM — entered its definitive financial phase on January 1, 2026. After a three-year transitional period of reporting-only obligations, importers shipping steel, aluminum, cement, fertilizers, electricity, and hydrogen into the European Union must now purchase carbon certificates to cover the embedded emissions in their goods. With certificate prices tracking the EU Emissions Trading System at roughly €70–€100 per tonne of CO₂, the cost implications for global supply chains are enormous.

What Is CBAM and Why Should Shippers Care?

CBAM is the world's first fully operational border carbon adjustment policy. Its purpose is straightforward: prevent "carbon leakage" — the practice of shifting production to countries with weaker climate regulations to avoid EU carbon costs. By pricing imported goods at the same carbon rate as EU-produced equivalents, the mechanism levels the playing field for European manufacturers while incentivizing cleaner production globally.

For logistics professionals, CBAM introduces a new cost layer that sits alongside tariffs, duties, and freight rates. Unlike traditional trade costs, this one is tied directly to the carbon intensity of production, not the value or weight of goods. That distinction fundamentally changes how shippers must think about sourcing, routing, and supplier selection.

Which Commodities Are Affected?

The initial scope covers six carbon-intensive sectors:

- Steel and iron — the largest category by import volume

- Aluminum — where projections show importers collectively facing liabilities near €500 million in 2026 alone

- Cement — heavily impacted due to high process emissions

- Fertilizers — particularly nitrogen-based products

- Electricity — cross-border power imports

- Hydrogen — added as the EU pushes its hydrogen economy strategy

The EU Commission has already signaled plans to expand CBAM's scope to additional downstream products, meaning shippers in automotive, construction, and manufacturing supply chains should prepare now.

Carbon Provenance: The Third Pillar of Landed Cost

Traditionally, logistics cost calculations have revolved around two pillars: freight cost and customs duties. CBAM introduces a third: carbon provenance — the verified emissions footprint of the goods being shipped.

This means that two identical shipments of steel arriving at Rotterdam from different origins can now carry vastly different landed costs depending on how that steel was produced. A tonne of steel from an electric arc furnace powered by renewables might carry a CBAM liability under €20, while the same tonne from a coal-fired blast furnace could cost over €150 in certificates.

For shippers, this creates a powerful incentive to:

- Audit supplier emissions data and request verified carbon intensity reports

- Diversify sourcing toward lower-carbon producers, even if base material costs are slightly higher

- Model total landed cost inclusive of carbon certificates before committing to procurement contracts

As Reuters has reported, companies should assume full implementation and act now — the regulatory trajectory points only toward expansion, not rollback.

The Compliance Challenge: Documentation and Data

CBAM compliance requires importers to become authorized CBAM declarants registered with their national authority. Each quarter, declarants must submit reports detailing the embedded emissions in their imports and surrender the corresponding number of CBAM certificates.

The data requirements are substantial:

- Direct emissions from production processes

- Indirect emissions from electricity consumed during production

- Verification by accredited third-party auditors

- Country-of-origin carbon pricing credits (if the exporting country has its own carbon pricing mechanism, those costs can be deducted)

For many importers, especially mid-market shippers managing hundreds of SKUs from dozens of suppliers, this creates a documentation burden that rivals customs compliance in complexity. The EU has published default emissions values for cases where actual production data is unavailable — but these defaults are deliberately set high to encourage actual data collection.

How TMS Platforms Must Adapt

The rise of carbon-as-a-cost-variable demands that Transportation Management Systems evolve beyond freight optimization. Modern TMS platforms need to:

- Integrate carbon accounting into shipment-level costing — treating CBAM certificates as a line item alongside freight, duties, and insurance

- Connect with supplier emissions databases — pulling verified carbon intensity data into procurement and routing decisions

- Automate quarterly CBAM reporting — aggregating shipment data, matching it to emissions factors, and generating compliant declarations

- Support scenario modeling — allowing shippers to compare total landed costs across sourcing options with different carbon footprints

The platforms that treat carbon compliance as an afterthought — a bolt-on report rather than an integrated workflow — will leave their users scrambling each quarter.

What Shippers Should Do Now

Even if your current EU-bound shipments don't fall within CBAM's initial six sectors, the direction of travel is clear. Here's a practical readiness checklist:

- Map your EU import exposure by commodity and origin country

- Request emissions data from suppliers — start the conversation now, even before it's required for your products

- Evaluate your TMS capabilities — can your platform handle carbon cost variables and CBAM-specific reporting?

- Monitor expansion timelines — the EU is expected to announce additional product categories by 2027

- Build carbon provenance into RFP criteria when selecting new suppliers or logistics providers

Looking Ahead

CBAM is more than a regulatory checkbox — it's a structural shift in how global trade is priced. As carbon costs become embedded in every cross-border transaction, the shippers who build carbon intelligence into their logistics operations today will have a decisive cost advantage tomorrow.

The EU is leading, but it won't be alone for long. The UK, Canada, and Australia are all developing their own border carbon mechanisms. Supply chains that adapt once, systematically, will be ready for all of them.

Need to integrate carbon compliance into your logistics workflows? Contact CXTMS to see how our platform handles emissions tracking, landed cost modeling, and regulatory reporting across your entire supply chain.