HS Codes

HS Codes (Harmonized System codes) are the foundation of international trade classification. This standardized numerical system enables customs authorities, importers, exporters, and logistics providers worldwide to uniformly identify and describe traded products for duties, taxes, regulations, and statistical tracking.

Every product crossing an international border requires an HS code — making accurate classification one of the most critical tasks in global logistics.

What is the Harmonized System?

The Harmonized Commodity Description and Coding System, commonly called the Harmonized System or HS, is a multipurpose international product nomenclature developed and maintained by the World Customs Organization (WCO).

Introduced in 1988, the HS is now used by more than 200 countries and economies, covering over 98% of world trade. It organizes more than 5,000 commodity groups into a hierarchical structure with well-defined classification rules.

Primary Uses of HS Codes

| Use Case | Description |

|---|---|

| Customs Duty Assessment | Determine tariff rates applied to imported goods |

| Trade Statistics | Enable governments to track import/export volumes by product |

| Rules of Origin | Verify eligibility for preferential tariffs under free trade agreements |

| Regulatory Control | Identify products subject to licensing, quotas, or restrictions |

| Tax Administration | Apply VAT, excise, or environmental taxes based on product type |

| Shipping Documentation | Appear on commercial invoices, packing lists, and bills of lading |

| Logistics Planning | Inform carriers and forwarders of special handling requirements (e.g., dangerous goods) |

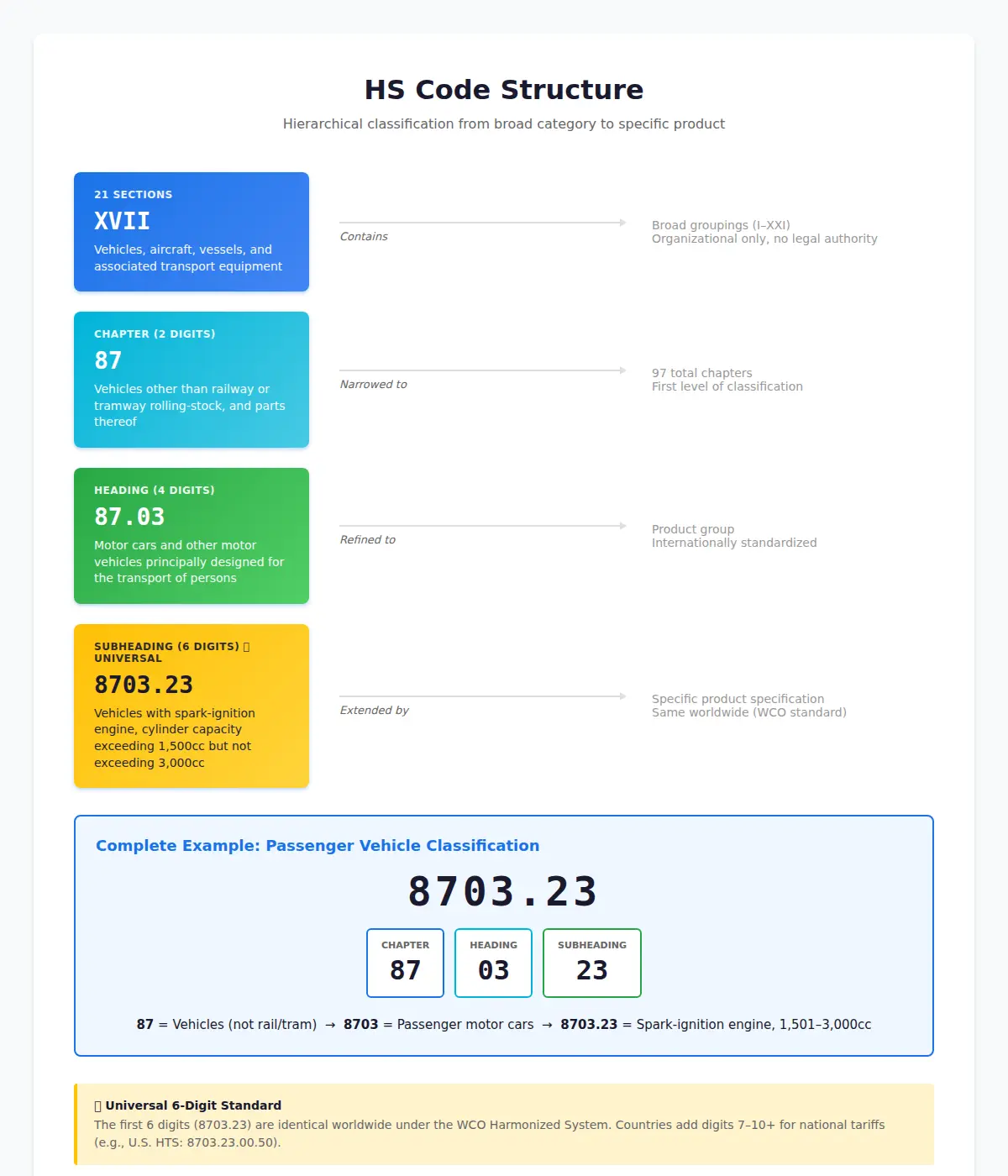

HS Code Structure

HS codes follow a hierarchical structure that moves from general categories to increasingly specific products.

The 6-Digit International Standard

The first 6 digits of an HS code are internationally standardized by the WCO. All countries using the HS system apply the same 6-digit codes for the same products. The structure breaks down as:

- Digits 1-2: Chapter (broad category)

- Digits 3-4: Heading (product group)

- Digits 5-6: Subheading (specific product detail)

Example: HS Code 8703.23

- 87 = Chapter 87: Vehicles other than railway or tramway rolling-stock

- 8703 = Heading: Motor cars and other motor vehicles principally designed for transporting persons

- 8703.23 = Subheading: Vehicles with spark-ignition internal combustion piston engine, cylinder capacity exceeding 1,500cc but not exceeding 3,000cc

National Extensions: 8, 10, or More Digits

Countries extend the 6-digit HS code with additional digits to capture finer product distinctions and apply country-specific tariffs.

| Region | Code Name | Digits | Example |

|---|---|---|---|

| United States | Harmonized Tariff Schedule (HTS) | 10 | 8703.23.00.50 |

| Canada | Canadian Tariff Schedule | 10 | 8703.23.90.00 |

| European Union | TARIC (Integrated Tariff of the EU) | 10 | 8703.23.11.10 |

| China | China Customs Tariff | 13 | 8703230090000 |

| India | Indian Trade Classification (ITC) | 8 | 87032390 |

The first 6 digits are always the same for a given product worldwide. Differences appear only in the country-specific extensions.

The 21 Sections of the Harmonized System

The HS is organized into 21 Sections, which are further divided into 97 Chapters (with reserved chapters up to 99). Sections provide broad groupings:

Section Overview

| Section | Chapters | Description |

|---|---|---|

| I | 01-05 | Live animals; animal products |

| II | 06-14 | Vegetable products |

| III | 15 | Animal/vegetable fats and oils |

| IV | 16-24 | Prepared foodstuffs; beverages; tobacco |

| V | 25-27 | Mineral products |

| VI | 28-38 | Products of chemical or allied industries |

| VII | 39-40 | Plastics and rubber |

| VIII | 41-43 | Raw hides, skins, leather |

| IX | 44-46 | Wood, cork, straw articles |

| X | 47-49 | Pulp, paper, printed books |

| XI | 50-63 | Textiles and textile articles |

| XII | 64-67 | Footwear, headgear, umbrellas |

| XIII | 68-70 | Stone, cement, ceramics, glass |

| XIV | 71 | Pearls, precious metals, jewelry |

| XV | 72-83 | Base metals and articles thereof |

| XVI | 84-85 | Machinery, electrical equipment |

| XVII | 86-89 | Vehicles, aircraft, vessels |

| XVIII | 90-92 | Optical, photographic, medical instruments; clocks |

| XIX | 93 | Arms and ammunition |

| XX | 94-96 | Miscellaneous manufactured articles (furniture, toys, sports equipment) |

| XXI | 97 | Works of art, collectors' pieces, antiques |

Section XVI (Chapters 84-85) — machinery and electrical equipment — is the largest and most complex section of the HS, accounting for a significant portion of global trade value.

General Rules of Interpretation (GRI)

Classification under the HS is governed by the General Rules for the Interpretation of the Harmonized System (GRI). These six rules must be applied in sequential order when determining the correct HS code for a product.

The Six GRIs

GRI 1: Terms of Headings and Notes

Classification is determined by the wording of headings and relevant section or chapter notes. Section and chapter titles are for reference only and have no legal standing.

Example: A wool sweater is classified by reading the heading for knitted garments (Chapter 61) and consulting notes on fiber content and construction.

GRI 2: Incomplete or Unfinished Articles

Articles presented unassembled or disassembled are classified as if complete, provided they have the essential character of the finished product.

Example: A bicycle sold in a box with the frame, wheels, handlebars, and pedals is classified as a complete bicycle (HS 8712), not as separate components.

GRI 3: Multiple Possible Classifications

When goods could fall under two or more headings, apply these sub-rules in order:

- GRI 3(a): Choose the most specific heading over a more general one

- GRI 3(b): If still unclear, classify by the component that gives the goods their essential character

- GRI 3(c): If still unclear, choose the heading that appears first in numerical order

Example: A gift set containing a bottle of perfume (33.03) and a cosmetic compact (33.04) is classified by essential character (likely the perfume, as it has the higher value).

GRI 4: Most Similar Goods

If classification cannot be determined by GRI 1-3, classify the goods with the most similar goods already classified in the HS.

This rule is rarely applied but exists as a fallback.

GRI 5: Packing Materials and Containers

Containers and packing materials are classified with the goods if they are of a kind normally used for those goods. Reusable containers (e.g., gas cylinders) may be classified separately.

Example: A wooden crate containing machinery is classified with the machinery, not separately as wood articles.

GRI 6: Subheading Comparisons

Apply GRI 1-5 when comparing subheadings within the same heading.

How to Classify a Product

Accurate HS classification requires a methodical approach:

Classification Workflow

Step-by-Step Process

-

Gather Product Information

- Material composition (what it's made from)

- Function or use (what it does)

- Method of manufacture (how it's made)

- Component parts (what it contains)

-

Identify the Section

- Review the 21 sections and identify which broad category fits your product

-

Find the Chapter

- Within the section, locate the chapter that best describes the product type

-

Read Section and Chapter Notes

- These notes define scope, exclusions, and specific classification rules

- Notes have legal authority — they can override what seems obvious from headings

-

Select the Heading (4 digits)

- Compare your product to the heading descriptions

- Apply GRI 1-4 if multiple headings seem applicable

-

Choose the Subheading (6 digits)

- Narrow down to the most specific subheading description

- Apply GRI 6 if comparing subheadings

-

Apply National Tariff Extensions

- Consult your country's tariff schedule (HTS, TARIC, etc.) for the full code

-

Validate Your Classification

- Cross-check with official customs databases

- Review WCO Classification Opinions if available

- Consider requesting a Binding Ruling from customs for certainty

- Relying on product marketing names instead of technical composition (e.g., a "sports drink" might be classified as a beverage or a food supplement depending on its formulation)

- Ignoring section and chapter notes that explicitly include or exclude certain products

- Classifying by intended use when the HS specifies classification by material (e.g., a plastic toy is classified in plastics, not toys, depending on the heading structure)

- Assuming similar products have the same code — small differences in material or function can result in different classifications

Binding Rulings and Classification Certainty

When classification is unclear or the financial stakes are high, importers can request a binding ruling (also called an advance ruling or classification ruling) from the customs authority.

What is a Binding Ruling?

A binding ruling is an official written decision by a customs authority that specifies the correct HS classification for a particular product. Once issued:

- The ruling is legally binding on the customs authority for a specified period (typically 3-6 years)

- The importer can rely on the ruling for all shipments of that product

- The ruling protects the importer from penalties if the ruling is later found to be incorrect

When to Request a Binding Ruling

| Scenario | Reason |

|---|---|

| High-value or high-volume imports | Tariff misclassification could result in significant overpayment or penalties |

| Products with unclear classification | Multiple headings seem applicable, or industry practice is inconsistent |

| Free trade agreement eligibility | Classification affects whether preferential duty rates apply |

| Regulatory compliance | Product is subject to import restrictions, licenses, or quotas based on HS code |

CXTMS integrates HS code databases and can flag shipments with uncertain classifications, prompting users to obtain binding rulings before clearing customs.

HS Code Updates: The 5-Year Revision Cycle

The WCO updates the Harmonized System approximately every five years to reflect changes in technology, trade patterns, and industry practices.

Recent Editions

| Edition | Effective Date | Major Changes |

|---|---|---|

| HS 2022 | January 1, 2022 | Added classifications for e-cigarettes, smartphones, 3D printers, drones; environmental and social amendments |

| HS 2017 | January 1, 2017 | Expanded agricultural products; new headings for consumer electronics |

| HS 2012 | January 1, 2012 | New codes for pharmaceutical products, chemicals |

Impact of HS Updates

When a new HS edition takes effect:

- Tariff schedules worldwide are updated to reflect the new structure

- Free trade agreement rules of origin may be revised to reference new codes

- Importers must reclassify products if their codes have changed or been split

- Binding rulings issued under the old HS may need to be reissued

Most countries provide a transition period of 3-6 months before enforcing penalties for using outdated HS codes, allowing importers time to update their systems.

Resources

| Resource | Description | Link |

|---|---|---|

| WCO Harmonized System | Official HS nomenclature, explanatory notes, and classification opinions | wcoomd.org |

| USITC HTS Search | U.S. Harmonized Tariff Schedule lookup with duty rates | hts.usitc.gov |

| EU TARIC Database | European Union integrated tariff and trade regulations | ec.europa.eu/taxation_customs |

| Trade.gov HS Guide | U.S. government guide to HS codes and classification | trade.gov/harmonized-system-hs-codes |

| Canada Tariff Finder | Canadian customs tariff lookup | cbsa-asfc.gc.ca |

Related Topics

- Import/Export Documentation — HS codes appear on commercial invoices, packing lists, and customs declarations

- Customs Bonds — Bond amounts may vary based on the HS code and duty rates

- Free Trade Agreements — HS codes determine eligibility for preferential tariff treatment

- Ocean Freight Rates — Some freight charges are tied to HS code classifications (e.g., hazardous cargo surcharges)