Truckload Capacity Is Tightening Again: How Carrier Exits and Spot Spikes Shape 2026 Freight Strategy

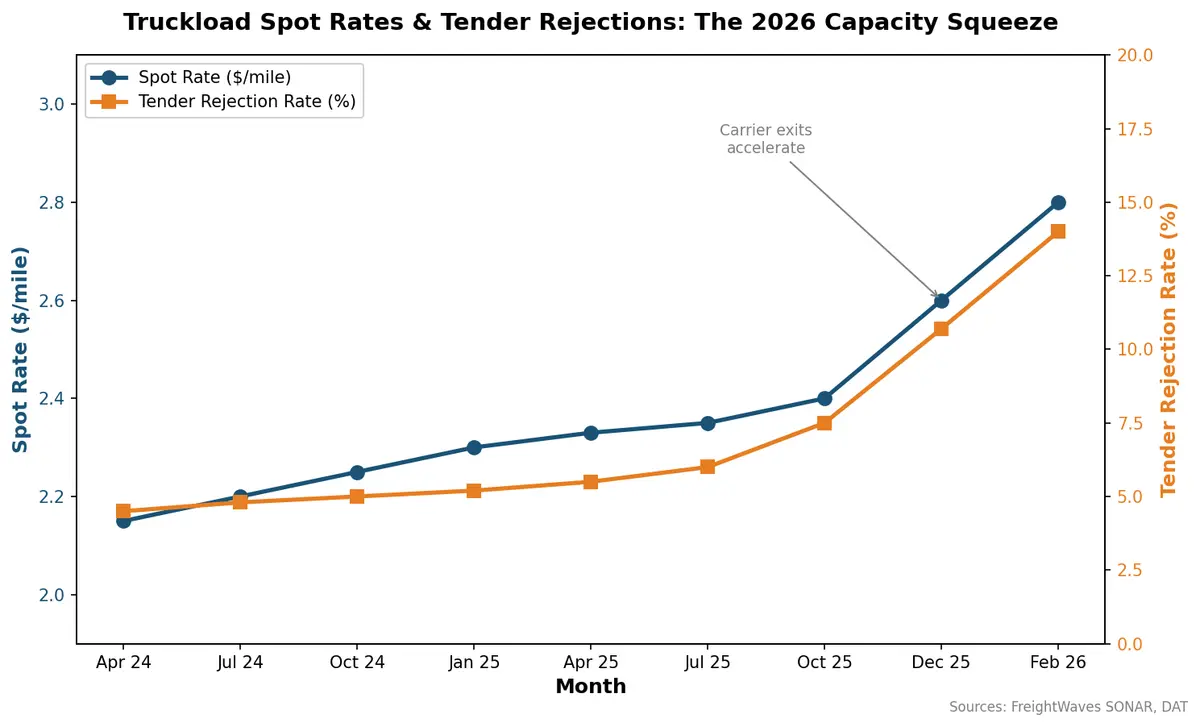

Truckload spot rates have surged to $2.80 per mile nationally — up 23% from $2.33 a year ago — and tender rejection rates are hovering near 14%, levels not seen since the last capacity crunch. After two years of a punishing freight recession, the trucking market is snapping back, and this time the tightening is driven by supply, not demand.

The February 2026 Snapshot: A Supply-Driven Squeeze

The numbers tell a clear story. According to FreightWaves' State of Freight analysis, spot rates and tender rejection rates have stayed elevated through early 2026 even though tender volumes are running 6–7% below year-ago levels. That's the critical insight: this isn't a demand boom pulling rates up. It's a supply contraction pushing them.

Through October 2025, approximately 2,125 carriers exited the market according to Motive's industry tracking — and that attrition hasn't stopped. Early 2026 data confirms carrier exits are continuing, steadily removing capacity from the system. The freight recession that began in 2022 finally achieved what many analysts predicted: it flushed out over-leveraged operators who entered during the pandemic boom.

What Tender Rejections at 14% Actually Mean

Tender rejection rates are one of the most reliable leading indicators in freight. When carriers reject contracted loads, it means they have better-paying options elsewhere — typically in the spot market. At 14%, we're well above the 5–6% floor that characterized 2024's oversupplied market.

For shippers, this translates to real operational pain:

- Routing guide failures are increasing. Your first-choice carrier is more likely to say no, pushing loads deeper into backup carriers or onto the spot market at premium rates.

- Lead times are stretching. Capacity that was available with a day's notice now requires earlier booking windows.

- Regional hotspots are emerging. The Southeast, Midwest, and Texas corridors are seeing the most acute tightening, with spot prices reacting sharply to weather events and seasonal demand shifts.

The shift from a buyer's market to something closer to equilibrium happened faster than most procurement teams anticipated. Shippers who locked in rock-bottom contract rates during the recession may find those rates increasingly difficult to execute against.

Carrier Exits: The Slow Burn That Changed Everything

The freight recession of 2023–2025 was historically brutal. Thousands of small and mid-size carriers — many of whom entered the market when spot rates topped $3.50 per mile during COVID — couldn't survive two years of sub-cost operating conditions.

This wave of exits created a structural shift. As FreightWaves reported, the question isn't just how many carriers left, but who absorbed their freight. Large fleets with deeper balance sheets picked up contract freight from failed competitors, tightening their own available capacity for spot loads. The result: even without a demand surge, the market feels materially tighter.

The coiled-spring analogy is apt. As one SONAR analyst put it during a December 2025 briefing, the market had been "on this tightened coil" for an extended period, winding tighter with each month of carrier attrition. Now it's unwinding — and the energy release is showing up in rates.

Intermodal: The Cost-Conscious Alternative Gaining Momentum

With truckload rates climbing, shippers are rediscovering intermodal. According to C.H. Robinson's January 2026 market update, interest in converting truckload shipments to intermodal surged over the holidays and continues into Q1 RFP season. The math is straightforward: rail uses significantly less fuel per ton-mile than trucks, and on lanes over 500 miles, intermodal can deliver 10–20% cost savings versus truckload.

But intermodal isn't a silver bullet. Transit times are longer, service variability can be higher, and not every lane has competitive rail options. The shippers winning right now are those with the flexibility and visibility to dynamically choose between modes based on real-time rate conditions, capacity availability, and service requirements.

The 2026 Freight Strategy Playbook

The carrier exits of 2023–2025 reset the supply baseline. Tariff uncertainty and potential trade disruptions add another layer of unpredictability. Here's how forward-thinking shippers are adapting:

1. Diversify your carrier portfolio. Relying on two or three core carriers worked in a soft market. In a tightening one, you need depth — including asset-based carriers, brokers, and intermodal providers.

2. Build mode flexibility into your network. Lanes that were truckload-only should be evaluated for intermodal conversion, especially on corridors over 500 miles. Having pre-qualified intermodal options means you can shift when truckload rates spike.

3. Invest in real-time market intelligence. The difference between paying $2.50 and $3.20 per mile on a spot load often comes down to timing and information. Shippers with live rate benchmarking and capacity visibility make better decisions faster.

4. Re-examine contract strategies. Mini-bids, index-linked contracts, and shorter commitment periods give you more flexibility than annual fixed-rate agreements in a volatile environment.

5. Strengthen shipper-carrier relationships. In a tight market, carriers prioritize shippers who treated them well during the downturn. Consistent volume, fair rates, and efficient facilities matter more than ever.

How CXTMS Helps You Navigate Capacity Shifts

CXTMS gives logistics teams the multi-modal visibility and rate intelligence needed to thrive in volatile markets. With integrated truckload, LTL, and intermodal rate comparison, automated carrier selection, and real-time market benchmarking, CXTMS helps shippers make smarter mode and carrier decisions — before capacity disappears.

Whether you're managing a tightening truckload market or exploring intermodal alternatives, having the right platform means the difference between reactive scrambling and proactive strategy.

The truckload market is shifting. Is your freight strategy ready? Contact CXTMS for a demo and see how multi-modal optimization keeps your supply chain moving.