UPS Automates 127 Buildings and Counting: What the Parcel Automation Surge Means for Shippers

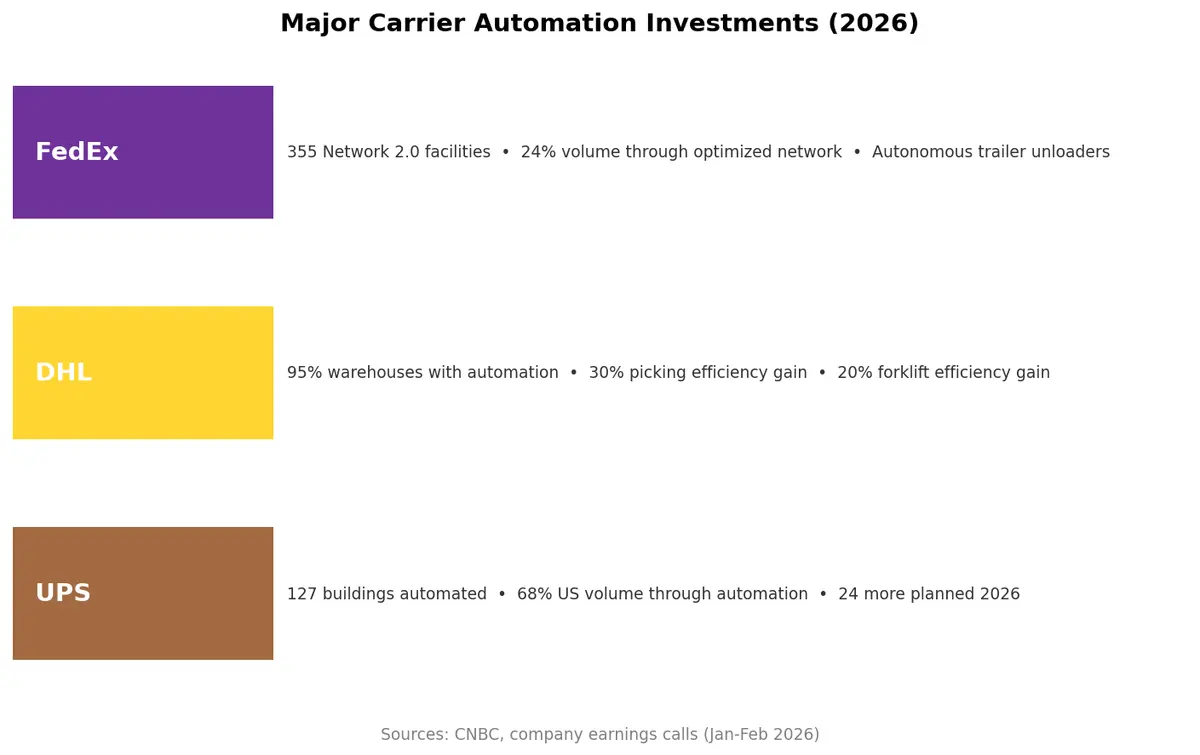

The race to automate parcel logistics just shifted into overdrive. On a late-January earnings call, UPS CEO Carol Tomé revealed the company has now deployed automation across 127 buildings — with 24 more planned for 2026. By year-end, 68% of all U.S. volume will flow through automated facilities, up from 66.5% at the close of 2025.

This isn't a UPS story alone. DHL, FedEx, and virtually every major logistics provider are pouring billions into robotic sorting, autonomous mobile robots, and AI-driven warehouse orchestration. For shippers who depend on these networks, the implications are profound — and the window to adapt is narrowing.

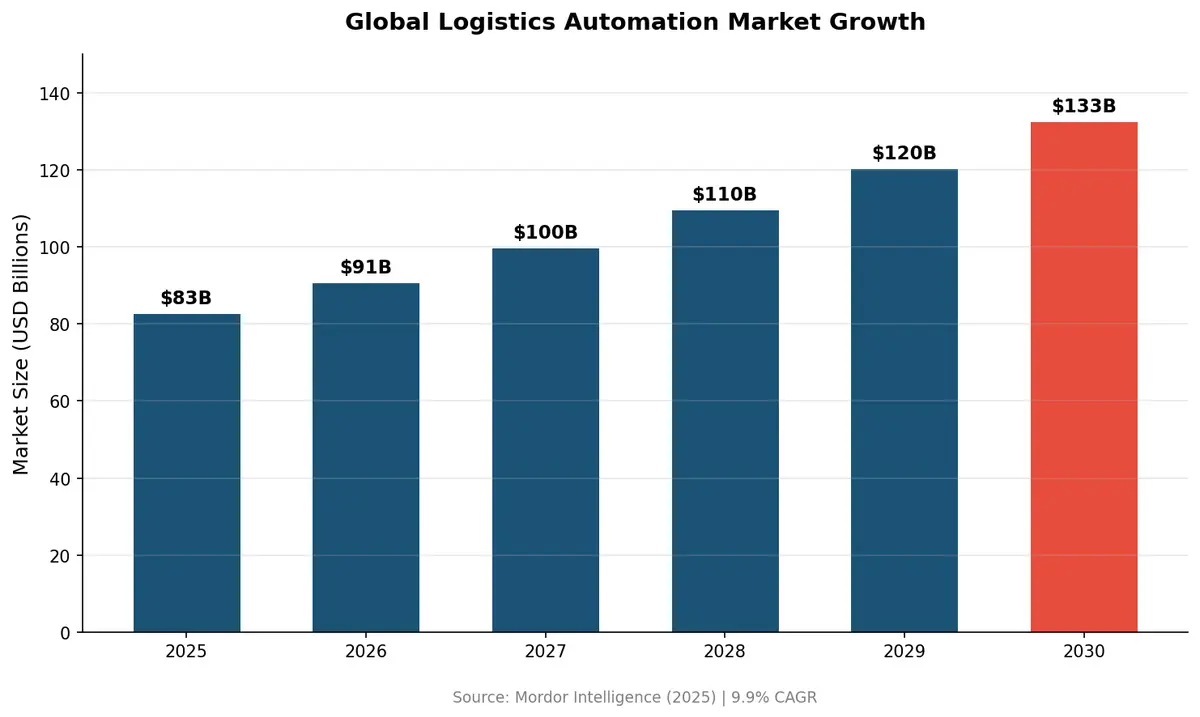

The Numbers Behind the Automation Wave

The logistics automation market reached $82.69 billion in 2025 and is projected to hit $132.57 billion by 2030, growing at a 9.9% CAGR according to Mordor Intelligence. E-commerce parcel volumes and persistent labor shortages are the twin engines driving this expansion.

UPS's automation push is part of a broader restructuring that included closing 93 buildings in 2025 and planning to shutter at least 24 more in early 2026. The math is straightforward: fewer, smarter facilities processing more volume at lower cost per package.

FedEx is on a parallel track. Its "Network 2.0" initiative now routes 24% of eligible daily volume through 355 optimized facilities. The company recently partnered with Berkshire Grey to deploy fully autonomous robotic trailer unloaders, and it estimates the global warehouse automation market will exceed $51 billion by 2030.

DHL's Human-Complementary Approach

While UPS consolidates and automates aggressively, DHL has taken a deliberately different path. The company has scaled automation across 95% of its global warehouses — but with a philosophy centered on augmenting human workers rather than replacing them.

"We still have the ambition to grow our business even further, but it's typically very tough to find additional labor or even additional spaces just to build these warehouses," Tim Tetzlaff, DHL's global head of digital transformation, told CNBC.

DHL's item-picking robots have increased units picked per hour by 30%, while autonomous forklifts contributed a 20% efficiency gain. The company recently announced a five-year alliance with Robust.AI to deploy hundreds of collaborative Carter robots across the Americas — robots designed to work alongside humans, not instead of them.

This "cobots over replacement" approach matters because it demonstrates that automation ROI doesn't require mass layoffs. It requires smarter integration.

What This Means for Mid-Size Shippers

If you're shipping fewer than 10,000 parcels a day, you're not building your own automated sorting facility. But you're absolutely affected by what UPS, FedEx, and DHL are building:

Faster transit times. Automated hubs process packages faster with fewer errors. As carriers push more volume through optimized facilities, shippers benefit from tighter delivery windows without paying premium rates.

Rate pressure shifting. Carriers investing billions in automation need returns. Expect surcharges and rate structures to increasingly reward shippers who make their packages "automation-friendly" — consistent dimensions, scannable labels, predictable volumes.

Service tier divergence. Automated networks enable carriers to offer sharper differentiation between economy and express tiers. Shippers who can flex between carriers and service levels will capture the most value.

Integration requirements rising. Automated facilities run on data. Carriers increasingly expect electronic manifesting, advance shipment notifications, and API-based booking. Manual processes create friction that automated systems don't tolerate well.

Building Your Automation-Ready Strategy

Mid-size shippers don't need billion-dollar capex budgets to benefit from the automation surge. They need smart systems that connect to automated carrier networks seamlessly:

- Multi-carrier rate optimization that automatically selects the best carrier and service level based on real-time capacity and pricing

- Label and packaging standardization that meets automated sorting requirements across carriers

- API-first integration with carrier systems for electronic booking, tracking, and exception management

- Data analytics that reveal which carriers deliver the best performance for specific lanes and package types

The shippers who thrive in 2026 won't be the ones who automate their own warehouses. They'll be the ones whose TMS platforms speak the same digital language as UPS's 127 automated buildings, DHL's collaborative robots, and FedEx's Network 2.0 facilities.

The logistics automation wave is reshaping how parcels move globally. Contact CXTMS to see how our platform connects your shipping operations to the automated networks of tomorrow.