Standard Forwarding's Closure Signals Deeper Trouble: The Quiet Crisis Facing Regional LTL Carriers in 2026

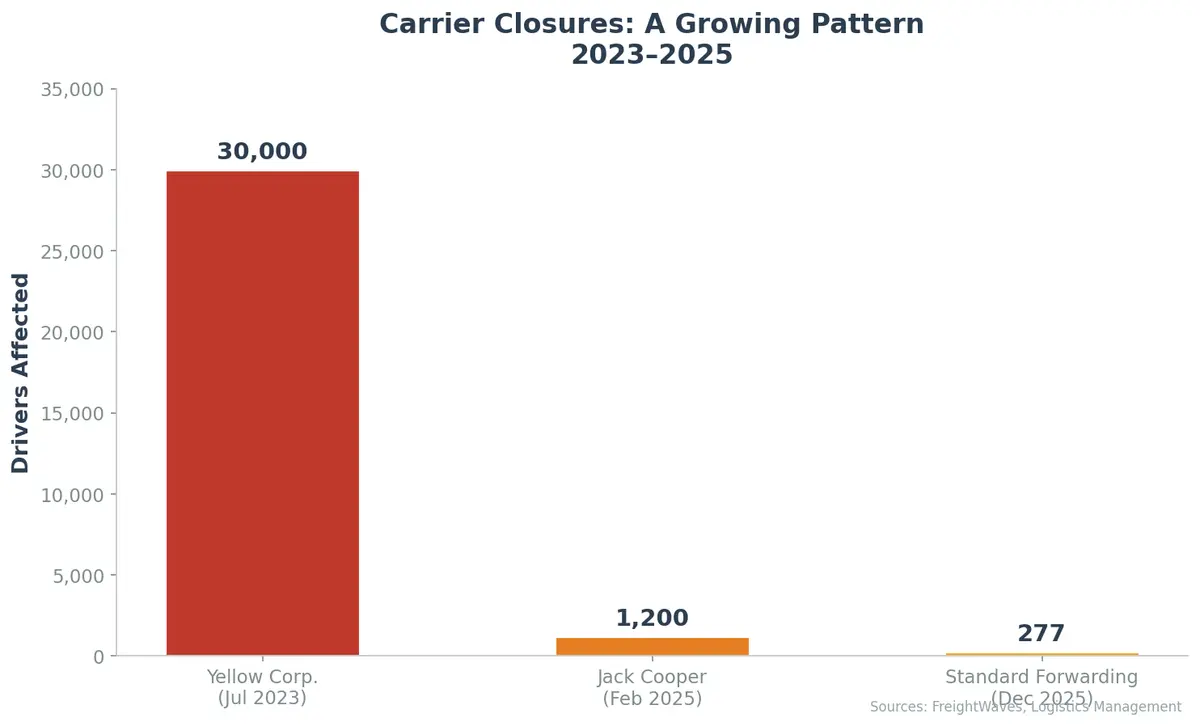

When a 91-year-old Midwest LTL carrier shuts its doors without warning, it's more than a headline — it's a signal. Standard Forwarding Freight suspended operations on December 29, 2025, leaving 277 drivers without jobs and shippers across five states scrambling for alternatives. The Teamsters called the closure "completely unexpected." But for anyone watching the regional LTL market closely, the warning signs were there all along.

What Happened to Standard Forwarding

Standard Forwarding Freight, based in East Moline, Illinois, had operated 14 terminals across Illinois, Indiana, Iowa, Minnesota, and Wisconsin for over nine decades. The carrier specialized in next-day and second-day delivery across the Midwest, partnering with other carriers for national reach.

The trouble began when DHL Freight sold the company in January 2025 to Sakaem Holdings — a subsidiary connected to the family behind Jack Cooper, the car hauler that ceased operations in February 2025 after losing contracts with Ford and General Motors. The new leadership, composed largely of former Yellow Corp. executives, attempted to revive the operation but couldn't overcome the financial headwinds.

By late December 2025, drivers were notified of their termination on a Sunday. A recorded message on the company's main phone line confirmed Standard Forwarding was "no longer scheduling pickups." The Teamsters National Freight Director described the shutdown as a complete surprise, with no prior communication about challenges or attempts to negotiate alternatives.

A Pattern Shippers Can't Ignore

Standard Forwarding's closure may be smaller in scale than Yellow Corp.'s July 2023 collapse — Yellow controlled roughly 10% of the $53 billion LTL market — but the pattern is unmistakable. Regional carriers are being squeezed from every direction.

According to Logistics Management's 2026 LTL market update, industry leaders describe the current freight environment as the softest in a generation. Chuck Hammel, president of Pitt Ohio, summarized it in one word: "tepid." Peter Latta, chairman and CEO of A. Duie Pyle, offered an even bleaker assessment: "Nothing jumps off the page to me to indicate an economic resurgence is around the corner that will materially improve the freight market."

The numbers tell the story. LTL volumes remain flat to slightly down year-over-year heading into 2026, while operating costs — terminal leases, insurance, labor, and equipment — continue to climb. Unlike truckload, where excess capacity simply suppresses rates, LTL carriers operate on fixed networks with high terminal costs. Every empty dock door and underutilized trailer burns cash regardless of volume.

The Post-Yellow Reshuffling

When Yellow shut down in 2023, its freight didn't simply redistribute evenly. The largest carriers — FedEx Freight and Saia — moved aggressively to acquire Yellow's 325 terminals and absorb market share. Old Dominion Freight Line considered bidding on the entire portfolio but balked when metropolitan terminal prices exceeded $100 million each.

This consolidation created a two-tier market. The top national carriers emerged stronger, with expanded terminal networks and improved lane density. Regional carriers, meanwhile, found themselves competing for shrinking volumes against better-capitalized competitors operating on networks that now included former Yellow terminals in their backyards.

As C.H. Robinson's February 2026 LTL market update notes, freight from a carrier exit "rarely re-enters the market without friction, particularly in regional LTL, where lane balance, terminal density, and shipment characteristics play an outsized role in economics." Standard Forwarding's closure reinforces the prolonged pressure regional carriers face in what has become a drawn-out freight recession.

The Truckload Crossover Threat

Adding pressure from an unexpected direction, struggling truckload carriers have lowered their minimum shipment weights to as little as 10,000 pounds — directly encroaching on traditional LTL territory. This crossover siphons volume from regional LTL networks that depend on density to maintain profitability.

SJ Consulting principal Satish Jindel has warned that the industry risks sliding into the same destructive environment that followed the 2008–2009 downturn, when major carriers launched a discounting war that took the LTL sector five years to recover from. So far, pricing discipline has held — ODFL led a 4.9% general rate increase in late 2025, with FedEx and ABF matching — but regional carriers without the scale to absorb volume fluctuations remain vulnerable.

What Shippers Should Do Now

Standard Forwarding's closure is a wake-up call for any shipper relying heavily on regional LTL carriers. Here's how to protect your freight network:

Monitor carrier financial health actively. Don't wait for a Sunday phone call. Track equipment age, out-of-service rates, and driver turnover as leading indicators of distress. Public FMCSA data showed Standard Forwarding's warning signs well before the shutdown.

Diversify your carrier base. If a single regional carrier handles more than 30% of your LTL volume in any lane, you're exposed. Build relationships with at least two backup carriers per region and keep them active with regular freight to maintain service quality.

Stress-test your routing guide quarterly. Carrier exits create cascading disruptions — not just lost capacity but repricing across the affected region. Run scenario planning for your top five carriers disappearing overnight.

Negotiate contingency clauses. Build carrier-failure provisions into your contracts that allow rapid rate activation with alternative providers without starting a full RFP process.

Leverage technology for visibility. Real-time carrier performance monitoring, automated exception alerts, and dynamic carrier selection algorithms can shift freight away from at-risk providers before a crisis hits.

The Bigger Picture

The LTL market is not collapsing — it's consolidating. The $53 billion sector still commands strong pricing discipline, and the top carriers are investing heavily in terminals, technology, and service quality. But consolidation creates winners and losers, and regional carriers with thin margins, aging equipment, and limited terminal networks are increasingly on the wrong side of that equation.

For shippers, the lesson from Standard Forwarding — and Yellow before it — is that carrier risk management is no longer optional. It's a core competency.

Need better visibility into your LTL carrier network? Contact CXTMS for a demo of our carrier vetting, multi-carrier optimization, and real-time performance monitoring tools.