Pax Silica and the AI Supply Chain Alliance: What the US-India Tech Pact Means for Global Logistics

On February 20, 2026, India formally joined the US-led Pax Silica initiative at the India AI Impact Summit — a move that signals one of the most significant realignments of global technology supply chains in decades. For logistics professionals managing international freight flows, this isn't just geopolitics. It's a preview of where cargo volumes are heading next.

What Is Pax Silica?

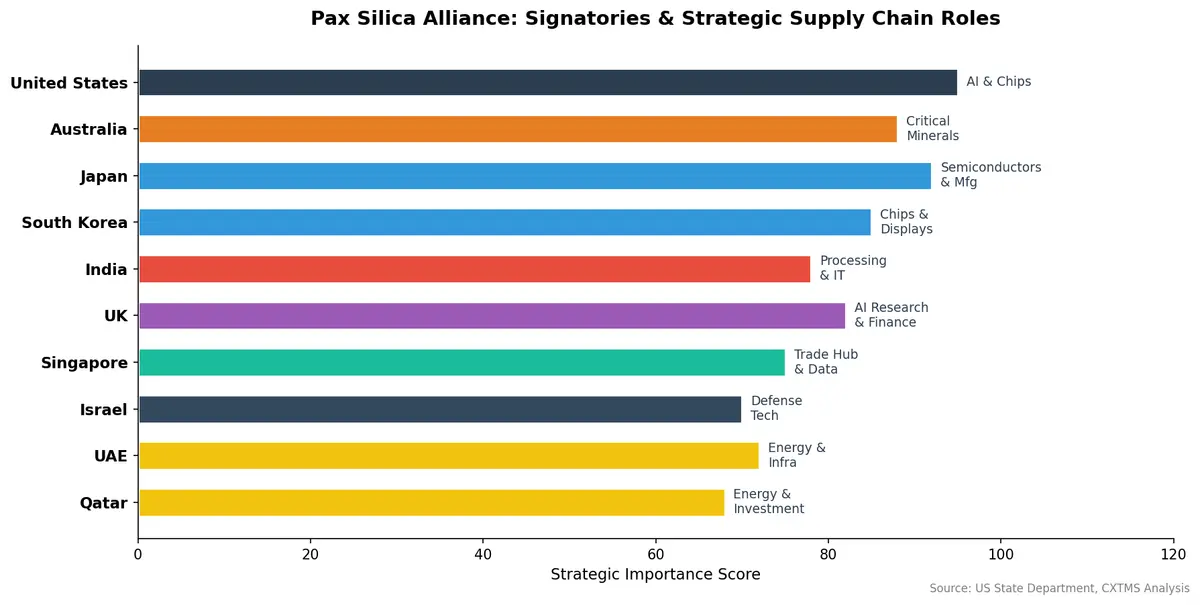

Launched in December 2025 by US Under Secretary for Economic Affairs Jacob Helberg, Pax Silica is a strategic alliance designed to secure the entire technology supply chain — from critical mineral extraction through semiconductor manufacturing to AI model deployment. The name itself is a nod to silicon, the foundational material of the digital economy.

The founding signatories read like a map of global tech capability: the United States, Australia, Japan, South Korea, the United Kingdom, Singapore, Israel, Qatar, the UAE, Greece, and now India. Canada, the European Union, and the Netherlands participate as non-signatory observers.

According to the US State Department, the alliance aims to "reduce coercive dependencies and forge new connections with reliable partners committed to fair market practices" — a direct response to China's 2023–2024 export restrictions on gallium, germanium, and rare earth processing technologies.

Why Logistics Professionals Should Pay Attention

Pax Silica isn't an abstract diplomatic exercise. It explicitly names transportation logistics as one of the strategic stack layers that member nations will coordinate on. That means new trade corridors, new compliance frameworks, and new freight volumes are coming — and shippers who anticipate these shifts will have a competitive advantage.

New India-Origin Sourcing Lanes

India's inclusion in Pax Silica accelerates a trend already underway: the diversification of technology manufacturing away from China. India is positioning itself as a semiconductor fabrication hub, with Tata Electronics and international partners building new chip facilities in Gujarat and Assam.

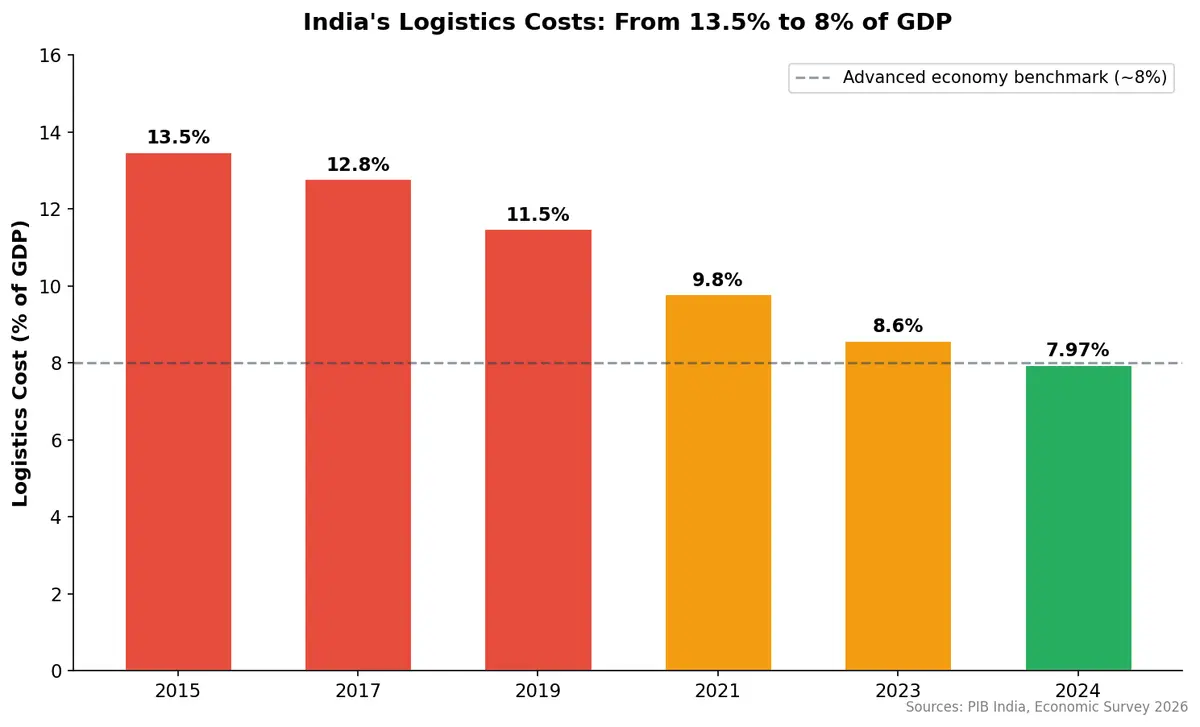

For shippers, this means new origin points for high-value, time-sensitive cargo. India's logistics infrastructure has improved dramatically — the country's logistics costs have fallen from over 13% of GDP a decade ago to 7.97% of GDP in 2024, finally reaching parity with advanced economies.

The PM GatiShakti national master plan has driven this transformation through coordinated infrastructure investment across rail, road, and port systems.

The PM GatiShakti national master plan has driven this transformation through coordinated infrastructure investment across rail, road, and port systems.

But challenges remain. India's customs processes, while improving, still involve more documentation than mature trade lanes. Multi-modal connectivity between ports and inland manufacturing clusters is uneven. Shippers opening new India-origin lanes need TMS platforms that can handle complex customs workflows and provide end-to-end visibility across fragmented transport networks.

China's Supply Chains Don't Disappear — They Reroute

The geopolitical pressure behind Pax Silica doesn't eliminate China's manufacturing dominance overnight. Instead, it's creating a shadow logistics network. As The Diplomat reported in January 2026, Chinese manufacturers have been shifting operations to Vietnam, Thailand, Malaysia, and Indonesia — not to serve local markets, but to reroute exports and avoid US tariffs.

"U.S. tariffs don't end Chinese exports. They reroute them," one logistics consultant told The Diplomat.

This rerouting creates complexity for shippers. Many Southeast Asian facilities still depend on Chinese raw materials and components, meaning a single shipment's supply chain may touch three or four countries before reaching its destination. Origin determination for customs compliance becomes a critical challenge — and getting it wrong means retroactive tariff exposure.

The Critical Minerals Bottleneck

Perhaps the most logistics-intensive element of Pax Silica is the critical minerals pillar. China currently controls approximately 60% of global rare earth mining and nearly 90% of rare earth processing. The alliance's goal is to build alternative processing capacity in Australia, India, and other member nations.

This creates entirely new freight flows for bulk minerals that previously moved almost exclusively through Chinese ports. Rare earth concentrates from Australian mines may soon route to Indian processing facilities rather than Chinese ones — a shift that requires new ocean freight contracts, specialized handling capabilities, and regulatory compliance across multiple jurisdictions.

For bulk and breakbulk carriers, this is a growth opportunity. For shippers of finished electronics and AI hardware, it means monitoring an expanding network of upstream suppliers across more countries than ever before.

What Shippers Should Do Now

1. Map your tech supply chain exposure. If you're shipping electronics, semiconductors, AI hardware, or products containing rare earth components, identify which origin countries and processing nodes are likely to shift under Pax Silica alignment.

2. Build India lane capability. Whether you're sourcing from India today or not, the infrastructure and trade incentives are converging to make India a major tech manufacturing origin within 24–36 months. Start vetting carriers, understanding customs requirements, and establishing freight benchmarks now.

3. Audit your China+1 strategy for transshipment risk. Goods routed through Southeast Asia to avoid tariffs face increasing scrutiny. Ensure your customs documentation accurately reflects origin and transformation, and that your TMS captures the full chain of custody.

4. Invest in multi-origin visibility. As supply chains fragment across more countries, real-time visibility becomes non-negotiable. A TMS that can track shipments across India, Southeast Asia, Australia, and traditional lanes simultaneously — with customs compliance built in — is no longer a nice-to-have.

The Bottom Line

Pax Silica marks the formalization of what supply chain professionals have felt building for years: the global logistics network is being rewired along geopolitical lines. The alliance's 10 signatory nations represent a massive share of global GDP and technology production, and their coordinated supply chain policies will reshape trade flows for a generation.

The shippers who thrive won't be the ones who react to these changes after they happen. They'll be the ones whose technology platforms — their TMS, visibility tools, and compliance systems — are built to adapt as new corridors emerge and old ones shift.

Navigating new trade corridors and multi-origin supply chains? Contact CXTMS to see how our platform helps shippers manage complexity across every lane.