LTL Consolidation Strategies for 2026: How AI Shipment Bundling Is Saving Shippers 20-35% on Freight Spend

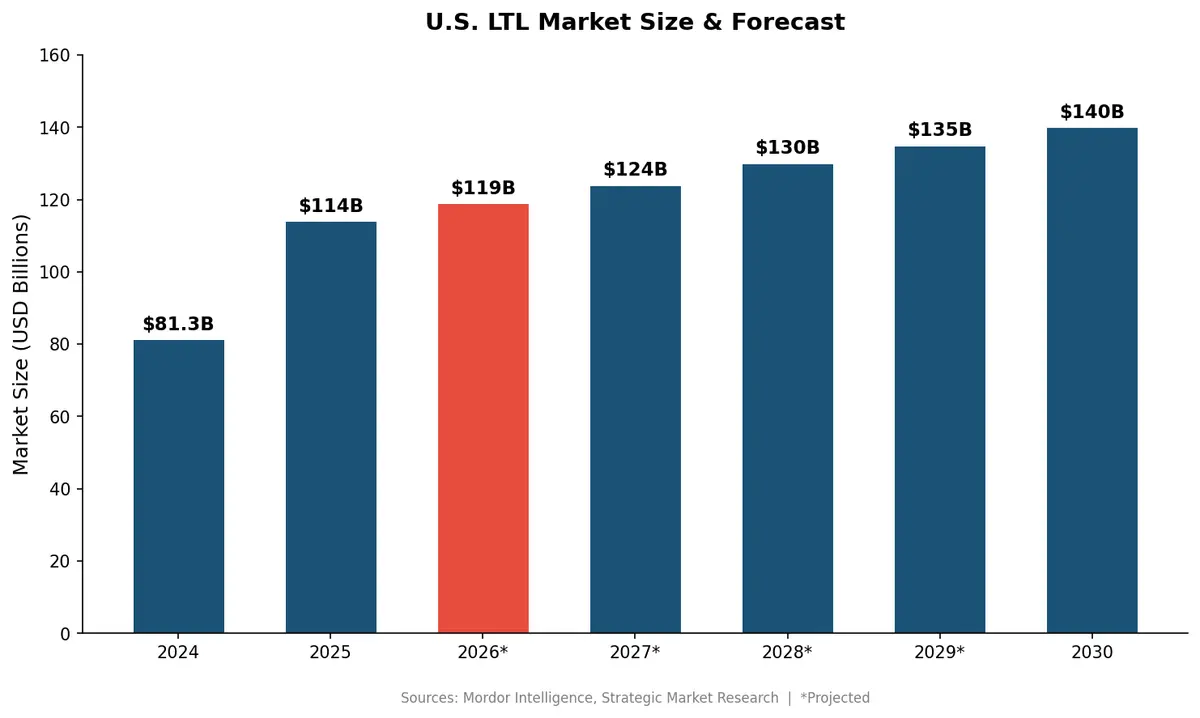

The U.S. LTL market is projected to reach $114 billion in 2025 and grow to nearly $140 billion by 2030, according to Mordor Intelligence. But with spot rates forecast to rise 6% year-over-year and capacity tightening across the board, shippers who still treat LTL as a transactional line item are leaving serious money on the table.

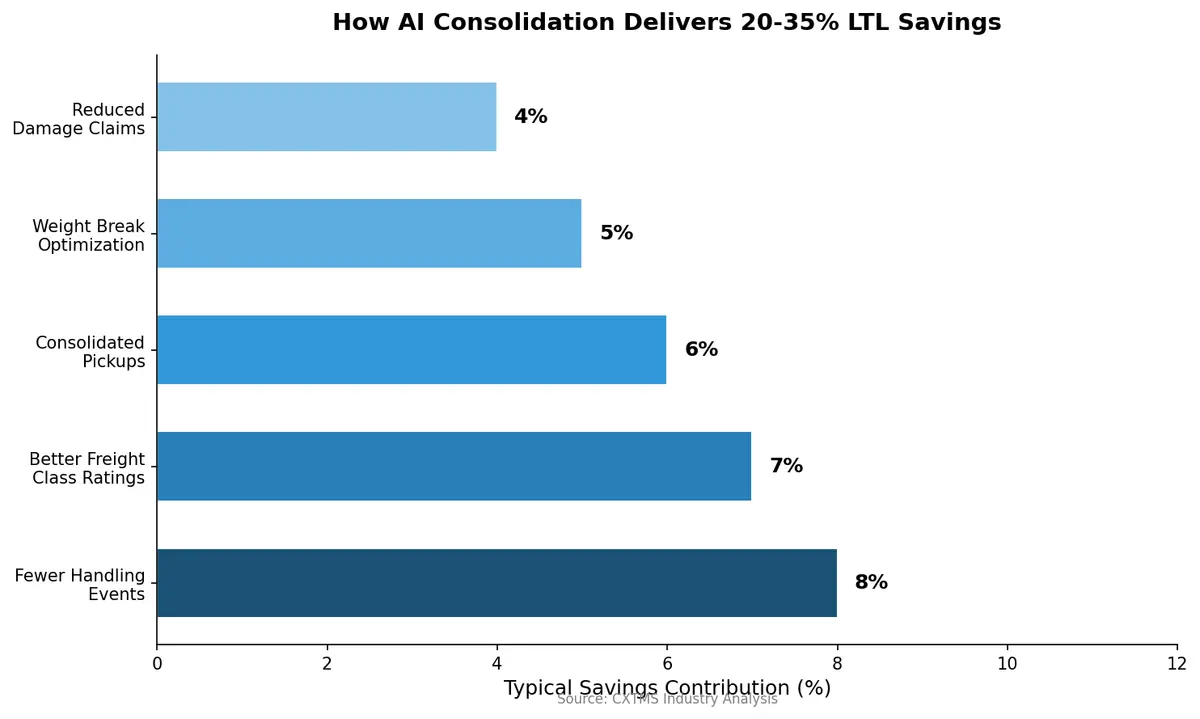

The solution isn't switching carriers or renegotiating rates alone — it's fundamentally rethinking how shipments move through LTL networks. AI-powered consolidation is emerging as the most impactful cost lever available to mid-market and enterprise shippers in 2026, with early adopters reporting 20–35% reductions in total LTL freight spend.

The LTL Market Is Tightening — and Getting More Expensive

After years of relatively favorable conditions, the freight market is shifting. C.H. Robinson's 2026 outlook projects that truckload capacity will normalize in the first half of the year, with tighter regulations and rising operational costs driving smaller carriers out of the market. As truckload capacity tightens and rates rise, smaller shipments get pushed back into LTL networks — increasing competition for terminal space and dock appointments.

LTL tonnage is expected to remain slightly negative year-over-year in the first half of 2026 before growing in the second half. That means carriers have pricing power now, and shippers who can't optimize their shipment profiles will absorb every rate increase.

The top four carriers — FedEx Freight, Old Dominion, XPO, and Estes Express — now control over 50% of the LTL market following Yellow Corp's 2023 collapse. That consolidation gives carriers more leverage on pricing, making shipper-side optimization more critical than ever.

What AI Shipment Bundling Actually Does

Traditional LTL shipping treats each shipment as an independent transaction: pick up at origin, move through the carrier's hub-and-spoke network, deliver to destination. Every touch point adds cost — handling fees, linehaul charges, fuel surcharges, and accessorial fees compound across each individual shipment.

AI consolidation flips this model. Instead of shipping five separate 3,000-pound pallets to destinations along a common corridor, an intelligent system bundles them into a single multi-stop truckload or consolidated LTL shipment. The math is straightforward:

- Fewer handling events reduce damage claims and accessorial charges

- Higher density shipments qualify for better freight class ratings

- Consolidated pickups lower per-shipment fuel surcharges

- Weight break optimization pushes shipments past pricing thresholds where per-pound rates drop significantly

The AI component matters because consolidation opportunities are dynamic. They depend on order timing, destination proximity, commodity compatibility, carrier network alignment, and dozens of other variables that change hourly. Rule-based systems catch the obvious bundles; machine learning catches the rest.

Dynamic Consolidation vs. Static Pool Points

The traditional approach to freight consolidation uses static pool points — fixed locations where shipments are aggregated before final delivery. This works for predictable, high-volume lanes but fails for the majority of shipping patterns.

Dynamic consolidation uses AI to identify bundling opportunities in real time across the entire shipment pipeline:

- Lane clustering algorithms group shipments heading to overlapping delivery zones, even when final destinations differ by 50–100 miles

- Time-window optimization identifies shipments that can be held 4–12 hours without missing delivery commitments, creating consolidation windows

- Commodity compatibility scoring ensures bundled freight doesn't create cross-contamination, temperature conflicts, or handling complications

- Carrier network matching aligns consolidated loads with carrier routes that already serve those corridors, improving tender acceptance rates

The result is a continuously optimized shipment plan that adapts to real order flow rather than historical averages.

The NMFC Classification Revolution

The National Motor Freight Traffic Association's 2025 overhaul of the NMFC classification system introduced a revised 13-subprovision density scale, replacing the previous 11-tier system. This change makes accurate freight measurement more important — and more rewarding — than ever.

AI-powered dimensioning and classification tools automatically:

- Calculate density from warehouse measurement systems or 3D scanning

- Assign optimal NMFC classes based on the new density tiers

- Identify reclassification opportunities where slight packaging changes push freight into lower-cost brackets

- Prevent carrier reweighs and reclassifications that trigger costly billing adjustments

Carriers like PITT OHIO are already applying AI-driven route optimization to reduce labor costs by 25% and sharpen service windows. Shippers who match that sophistication on the classification side capture savings from both ends of the transaction.

Building a Consolidation Strategy That Scales

Implementing AI consolidation isn't just a technology decision — it's an operational shift. Here's what high-performing shippers are doing in 2026:

1. Centralize shipment visibility. Consolidation requires seeing all pending shipments across facilities, business units, and order systems in one place. A TMS platform that aggregates orders from multiple ERPs and WMS instances is the foundation.

2. Establish consolidation rules with flexibility. Define maximum hold times, compatible commodity groups, and minimum consolidation savings thresholds — then let the AI optimize within those constraints.

3. Use mode-shift analysis. Some LTL shipments should shift to partial truckload or intermodal when volumes justify it. AI systems that evaluate across modes — not just within LTL — capture the largest savings.

4. Measure total cost, not just line-haul rates. Consolidation savings come from reduced accessorials, fewer claims, lower handling costs, and better carrier relationships. Track the full picture.

5. Leverage carrier partnerships. C.H. Robinson's 2026 guidance emphasizes that higher volume with preferred carriers leads to better tender acceptance and service levels. Consolidation naturally concentrates volume, creating a virtuous cycle.

Where CXTMS Fits

CXTMS provides the integrated shipment planning layer that makes AI consolidation practical. Multi-stop route optimization, automated carrier selection across LTL and partial truckload modes, and real-time consolidation recommendations are built into the platform's core workflow — not bolted on as afterthoughts.

For shippers managing 500+ LTL shipments per month, the consolidation engine identifies bundling opportunities across all active orders, applies carrier-specific pricing logic, and presents optimized plans that dispatchers can approve with a single click.

The difference between 2026's winners and everyone else in LTL won't be who negotiates the best base rate — it'll be who moves the smartest freight.

Ready to cut your LTL spend with intelligent consolidation? Contact CXTMS for a demo.