The Shipper's Market of Q1 2026: How to Lock In Favorable Freight Rates Before the Window Closes

Q1 2026 is delivering something shippers haven't seen in years: genuine leverage across nearly every freight mode. Capacity is plentiful, carriers are hungry for volume, and contract rates remain favorable — but early warning signs suggest this window won't stay open much longer.

The Current Market Snapshot: A Rare Alignment

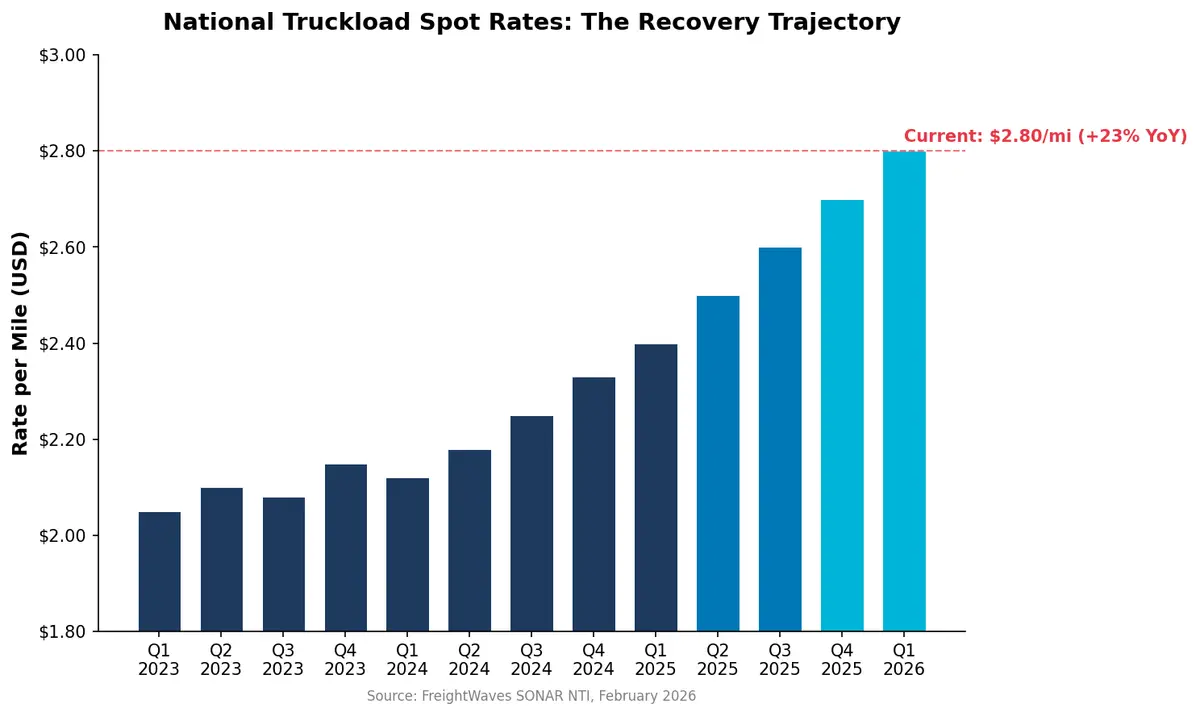

The freight market in early 2026 presents a complex but ultimately shipper-friendly picture. According to FreightWaves, the Outbound Tender Rejection Index (OTRI) has climbed to 13.40% — well above recent averages — signaling that carriers are beginning to push back on lower-paying contract freight. Meanwhile, the National Truckload Index shows spot rates firming around $2.80 per mile nationally, up 23% year-over-year from $2.33.

But here's the critical nuance: tender volumes are running roughly 6–7% below year-ago levels. This means the tightening is supply-driven, not demand-driven. More carriers are leaving the market than entering, creating a slow squeeze that hasn't yet translated into dramatic contract rate increases.

For shippers, this creates a narrow but powerful window. Carriers need volume to fill capacity, making them receptive to competitive contract terms. But the floor is firming, and waiting too long means negotiating into a rising market.

Why This Shipper's Market Is Different

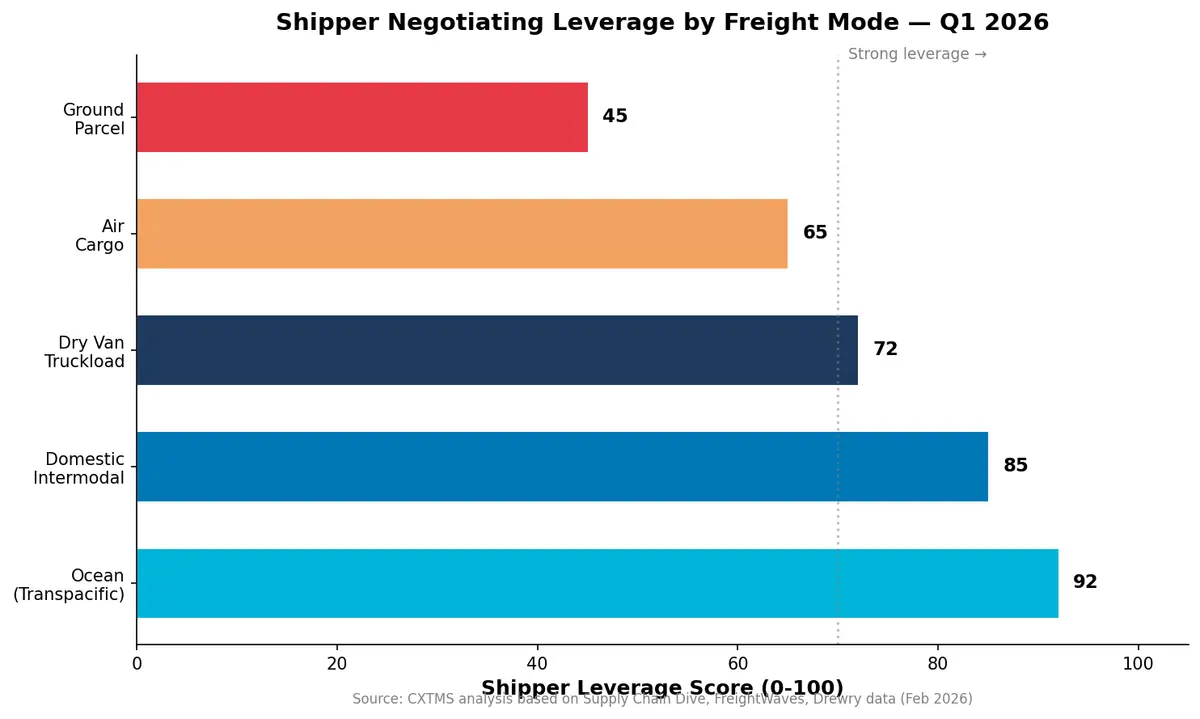

Unlike the deep freight recession of 2023–2024, when shippers could practically name their price, the 2026 landscape demands more nuanced strategy. As Supply Chain Dive reports, transportation capacity is readily available and shipper-friendly contract rates are within reach across parcel, ocean, air cargo, rail, and trucking. Industry experts note that "the pricing environment right now is still very, very favorable for shippers," though securing concessions takes more effort and deeper data analysis than in previous years.

Several factors make this market uniquely complex:

- Rising ancillary costs. Ground parcel rates are projected to be 38.9% higher than 2018 baselines in Q1 2026, a 5.4% year-over-year increase. Carriers are implementing mid-year adjustments and complex surcharges more frequently, making static budgeting nearly impossible.

- Ocean overcapacity persists. A 3.7% capacity increase is expected in ocean shipping for 2026, injecting an additional 1.5 million TEUs into the market. Ocean contract negotiations — typically occurring March through May — will especially favor shippers on Transpacific eastbound lanes.

- Specialized equipment tightness. Reefer rejections sit at approximately 22.5% and flatbed rejections at 24.8%, driven by early produce positioning and spring construction staging. Not every segment is equally favorable.

Five Tactical Strategies to Lock In Rates Now

1. Accelerate Your Contract Cycle

If your annual freight RFP typically runs in Q2, consider pulling it forward. The data suggests dry van linehaul rates could trough around $1.60 per mile by April or early May before climbing. Locking contracts before the trough passes gives you the best of both worlds: low base rates secured while carriers are still competing for volume.

2. Embrace Index-Linked Pricing

Rather than gambling on fixed rates in a transitional market, negotiate index-linked contracts that tie your rates to published benchmarks. This protects you if rates stay soft while giving carriers confidence they won't be locked into below-cost pricing if the market turns. It's a win-win structure that's gaining traction in 2026.

3. Run Mini-Bid Windows for Key Lanes

Don't wait for a single massive annual bid. Identify your top 20 freight lanes by spend and run targeted mini-bids quarterly. This lets you capture favorable rates on high-volume lanes immediately while maintaining flexibility on lanes where market conditions are still shifting.

4. Diversify Across Modes

With ocean overcapacity and intermodal rates sitting at 2020 lows, now is the time to shift eligible freight from over-the-road truckload to intermodal or ocean-rail combinations. The cost differential is significant, and service levels on domestic intermodal corridors have stabilized. According to FreightWaves, intermodal spot rates haven't kept pace with trucking's recovery — creating a meaningful arbitrage opportunity.

5. Monitor Carrier Financial Health

The flip side of a shipper's market is carrier stress. With more authorities being revoked than issued and regional carriers like Standard Forwarding shutting down, your routing guide is only as reliable as the carriers in it. Build financial health monitoring into your procurement process and maintain backup carriers for critical lanes.

The Hidden Cost Trap: Look Beyond Base Rates

One of the biggest mistakes shippers make in a favorable rate environment is focusing exclusively on linehaul rates while ignoring the total cost picture. As Sobel Network Shipping observes, success in 2026 depends on a shipper's ability to remain agile, anticipating cost fluctuations rather than simply reacting to them.

Key cost areas to watch:

- Fuel surcharges are decoupling from actual fuel costs, with some carriers using surcharge tables that haven't been updated to reflect current diesel prices.

- Accessorial charges for detention, layover, and limited-access deliveries are climbing even as base rates hold steady.

- Insurance and compliance costs are rising across the board, eating into the savings shippers capture on base rates.

The most effective procurement teams in 2026 are modeling total landed cost, not just per-mile rates. They're using TMS platforms with rate benchmarking capabilities to compare all-in costs across carriers and modes in real time.

The Clock Is Ticking

Multiple indicators suggest the shipper's market has an expiration date. Net carrier authorities are contracting. Spot rates have climbed 23% year-over-year. Tender rejections are at levels that historically precede market tightening. None of these individually signal an imminent flip, but together they paint a picture of a market slowly tilting back toward equilibrium.

Shippers who move decisively in Q1 2026 — locking favorable contracts, diversifying modes, and building resilient carrier networks — will be positioned to weather whatever comes next. Those who wait for "just a little more savings" may find themselves negotiating from a weaker position by Q3.

Ready to benchmark your freight rates and optimize procurement strategy? Contact CXTMS for a demo of our rate intelligence and carrier management platform.