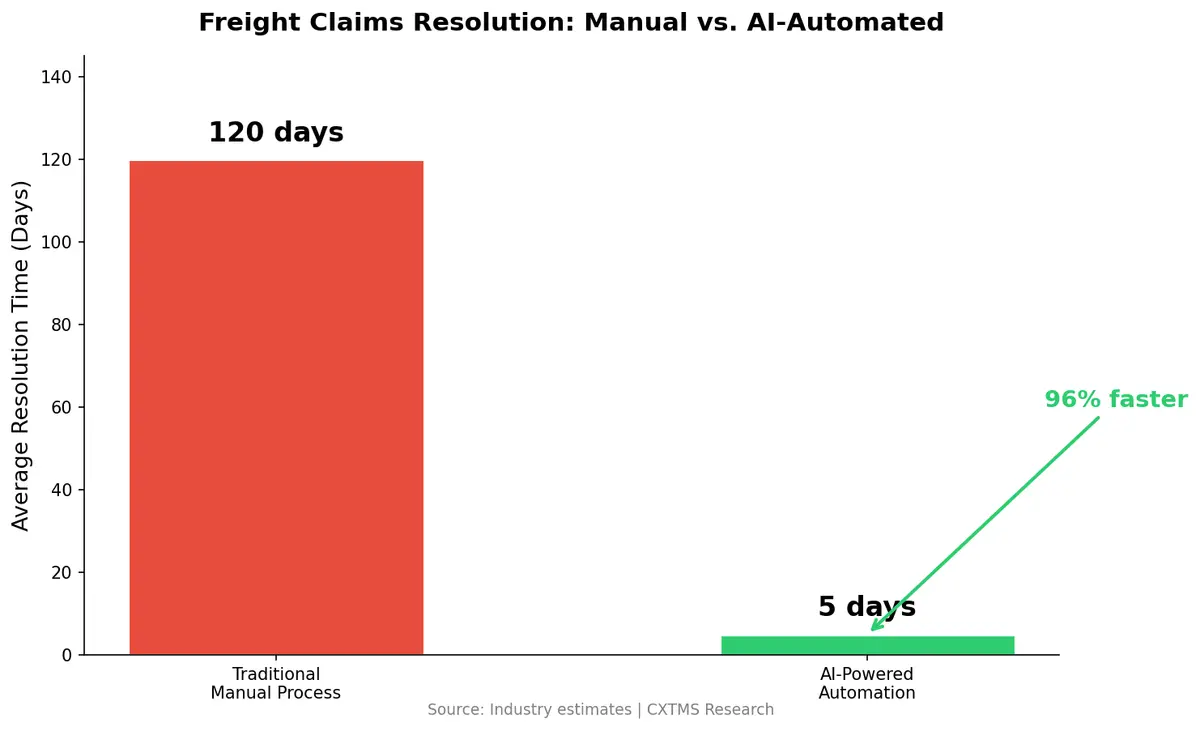

Freight Claims Management Goes Digital: How AI Is Turning a 120-Day Process Into Same-Week Resolution

Cargo loss and damage cost the global supply chain more than $50 billion every year. Yet for most shippers and carriers, the process of recovering those losses — filing freight claims — remains stuck in the fax-and-spreadsheet era. The average claim takes 120 days or more to resolve, buried under paper forms, email chains, and finger-pointing between parties who can't agree on when or where the damage occurred.

In 2026, that's finally changing. AI-powered claims platforms are compressing what used to be a quarter-long ordeal into same-week resolution — and the companies adopting them are recovering millions that previously fell through the cracks.

The Scale of the Problem

Freight claims aren't a rounding error. According to FreightClaims, cargo losses exceed $50 billion annually, driven by damage, theft, shortages, and contamination across every mode of transport. Infios reports that its claims management users alone filed more than half a million freight claims valued at nearly $1.5 billion in a single year.

And the problem is getting worse, not better. FreightWaves reports that cargo theft in the U.S. averaged 7.16 incidents per day in 2025 — up from 6.07 per day in 2024 — with projections for at least a 13% increase in 2026. CargoNet recorded 3,594 supply chain crime events across the U.S. and Canada in 2025. Every one of those events triggers claims paperwork that someone has to process.

The hidden cost isn't just the damaged goods — it's the administrative overhead. A single freight claim typically involves 15–20 documents: bills of lading, proof of delivery, inspection reports, photos, invoices, and carrier correspondence. When those documents live in email inboxes, filing cabinets, and disconnected spreadsheets, claims adjusters spend more time hunting for paperwork than actually resolving disputes.

Why Traditional Claims Management Fails

The traditional freight claims workflow hasn't fundamentally changed in decades:

- Discovery — Receiver finds damage, sometimes days after delivery

- Documentation — Photos taken on personal phones, notes scribbled on paper

- Filing — Claims submitted via email, fax, or carrier web portals (each carrier has a different process)

- Back-and-forth — Weeks of emails requesting additional documentation

- Resolution — Months later, a partial settlement arrives — if you're lucky

The biggest bottleneck? Inconsistent documentation at the point of damage. Without timestamped, geolocated proof of condition at pickup and delivery, carriers can dispute liability endlessly. The Carmack Amendment requires shippers to prove that goods were in good condition when tendered to the carrier, that they arrived damaged, and the monetary value of the loss. Missing any piece means a denied claim.

Most companies recover only 30–50% of eligible claim value simply because they can't assemble the documentation fast enough before filing deadlines expire.

How AI Is Rewriting the Claims Playbook

The new generation of freight claims technology attacks every friction point simultaneously:

Automated Damage Assessment

Computer vision models trained on millions of freight images can now classify damage types — crushed corners, water damage, pallet shifts, seal tampering — within seconds of a photo being uploaded. Instead of waiting for a human inspector, AI provides an instant severity assessment and estimated loss value, accelerating the triage process from days to minutes.

Intelligent Document Collection

OCR and natural language processing extract relevant data from bills of lading, PODs, and inspection reports automatically. AI algorithms scan incoming emails, categorize claim-related documents, and match them to the correct shipment — eliminating the manual sorting that consumes hours of adjuster time every day.

Predictive Claim Scoring

Machine learning models analyze historical claim outcomes to predict which claims are likely to be approved, which will be disputed, and what documentation gaps need to be filled before filing. This lets teams prioritize high-value, high-probability claims and avoid wasting effort on claims destined for denial.

Chain-of-Custody Tracking

IoT sensors and blockchain-verified delivery records create a tamper-proof chain of custody. When every handoff is digitally recorded — with temperature, shock, and location data — liability disputes that used to drag on for months get resolved with objective evidence.

The Business Case for Digital Claims

The ROI on claims automation compounds across multiple dimensions:

- Faster recovery — Claims resolved in 5–7 days instead of 120+ means cash returns to the business faster

- Higher recovery rates — Automated documentation capture closes the evidence gaps that lead to denials, pushing recovery rates from 30–50% toward 70–85%

- Reduced labor costs — A single claims analyst using AI tools can handle 3–4x the volume of manual processors

- Better carrier accountability — Data-driven damage patterns reveal which carriers, lanes, and facilities generate the most claims, enabling targeted corrective action

For a mid-size shipper filing 500 claims per year with an average claim value of $2,500, increasing recovery rates from 40% to 75% represents an additional $437,500 in annual recoveries — often exceeding the total cost of the claims platform.

Building a Modern Claims Workflow

Companies transitioning to digital claims management should focus on three foundational capabilities:

1. Capture at the dock door. Equip receiving teams with mobile tools that photograph, timestamp, and geolocate every delivery exception in real time. The best evidence is captured in the moment, not reconstructed from memory days later.

2. Centralize and automate. Replace carrier-specific filing processes with a unified claims platform that auto-populates forms, tracks deadlines, and escalates stalled claims. Integration with your TMS ensures shipment data flows into claims without re-keying.

3. Analyze and prevent. Use claims data to identify root causes. If 40% of your damage claims originate from a single carrier on a specific lane, the solution isn't better claims processing — it's better carrier selection. Platforms like CXTMS connect claims data back to carrier scorecards and routing decisions, turning reactive recovery into proactive prevention.

What's Next: From Recovery to Prevention

The ultimate goal isn't faster claims — it's fewer claims. As AI-powered analytics mature, the industry is shifting from managing damage to predicting and preventing it. Predictive models that flag high-risk shipments before they move, recommend packaging upgrades for fragile lanes, and automatically route sensitive freight to carriers with the best damage records are already in pilot programs across major 3PLs.

The $50 billion freight claims problem won't disappear overnight. But the companies that digitize their claims workflow today will recover more, spend less on administration, and — most importantly — use claims data as a strategic tool to drive continuous improvement across their supply chain.

Tired of chasing paper trails for freight claims? Contact CXTMS to see how integrated claims management and carrier scorecards can protect your bottom line.