Sub-Tier Supply Chain Mapping: Why Visibility Beyond Your Direct Suppliers Is the Biggest Risk You're Ignoring

Most supply chain leaders can name their direct suppliers. Far fewer can tell you where those suppliers source their raw materials, who manufactures the sub-components, or which Tier 3 factory is one earthquake away from halting their entire production line. That blind spot is no longer just a risk management gap — it's becoming a regulatory liability.

The Visibility Gap That Keeps Getting Exposed

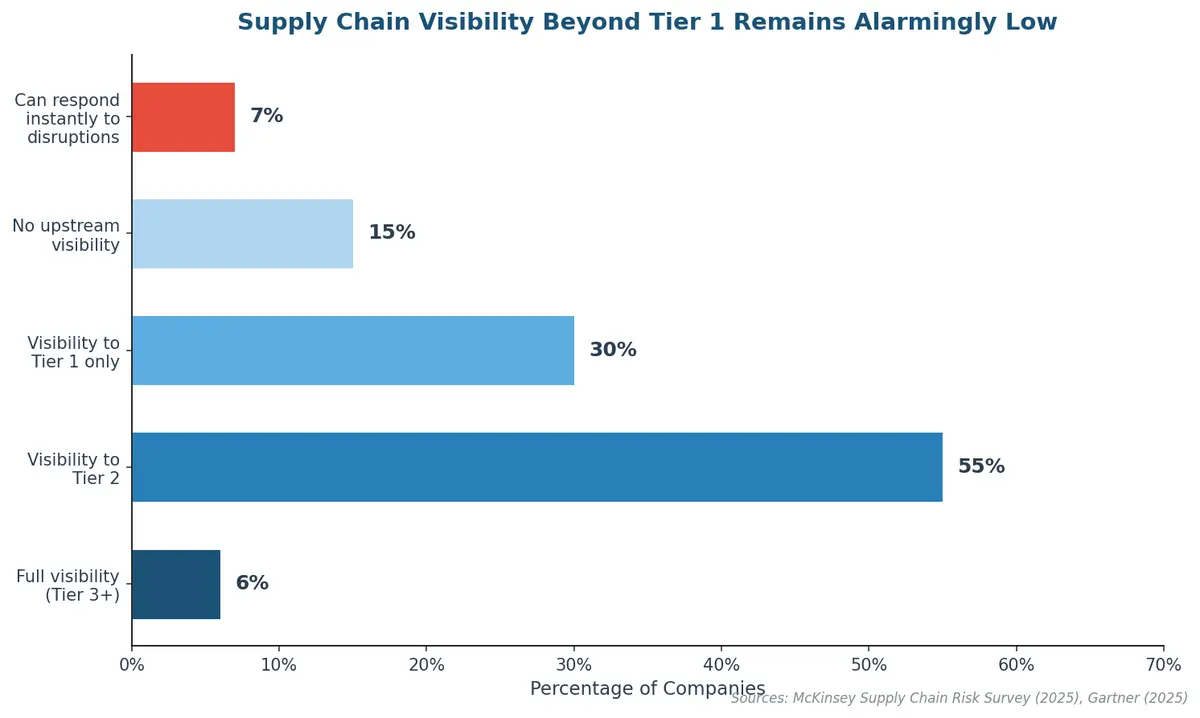

A McKinsey supply chain risk survey found that 45% of companies either have no visibility into their upstream supply chain or can see only as far as their first-tier suppliers. While that number has improved — McKinsey noted a 22 percentage-point increase in organizations with Tier 2 visibility between 2023 and 2025 — the gap remains staggering for something so critical.

The consequences are not theoretical. When the semiconductor shortage cascaded through the automotive industry in 2021–2023, most OEMs discovered they had no direct relationship with — or even awareness of — the Tier 3 and Tier 4 chip fabrication plants that controlled their production schedules. Companies lost an estimated $210 billion in automotive revenue alone because they couldn't see past their Tier 1 module assemblers.

According to Gartner, just 7% of supply chain leaders say they have the infrastructure to respond instantly to disruptions — a figure that underscores how deeply the sub-tier visibility problem runs.

Where the Hidden Risks Actually Live

The risks buried in sub-tier supply chains fall into three categories that compound each other:

Concentration risk. A single Tier 3 supplier may feed dozens of your Tier 1 vendors without you knowing it. When that supplier fails, the disruption appears to come from multiple directions simultaneously. Rare earth minerals, specialty chemicals, and semiconductor substrates are common concentration bottlenecks.

Geopolitical exposure. Trade policy shifts — tariffs, export controls, sanctions — hit sub-tier suppliers hardest because they are often located in regions with the highest regulatory volatility. Deloitte's 2026 Manufacturing Outlook highlights how AI agents are now being deployed to monitor Tier 1 and Tier 2 suppliers for disruptions caused by trade policies, tariffs, and weather events.

Compliance liability. This is where the landscape is changing fastest, and where ignoring sub-tier visibility may soon carry direct financial penalties.

The EU CSDDD Changes Everything

The European Union's Corporate Sustainability Due Diligence Directive (CSDDD), formally adopted in July 2024, is the single biggest regulatory driver for sub-tier mapping. Unlike previous voluntary frameworks, the CSDDD requires companies to identify, prevent, and mitigate human rights and environmental impacts throughout their entire chain of activities — not just direct suppliers.

The directive applies to EU companies with more than 1,000 employees and €450 million in net worldwide turnover, as well as non-EU companies generating equivalent revenue within the EU. Implementation begins in a staggered rollout from 2027 to 2029, but companies preparing for compliance are already discovering they need years of groundwork to map their upstream networks.

The penalty structure is what makes this different from voluntary ESG reporting: member states must establish supervisory authorities with power to impose fines of up to 5% of global net turnover. The directive also introduces civil liability, meaning affected parties can sue companies for failing to conduct adequate due diligence.

For logistics and supply chain teams, this means sub-tier mapping is no longer a "nice to have" risk management exercise — it's a compliance requirement with teeth.

How AI Is Making Multi-Tier Mapping Possible

Historically, mapping beyond Tier 1 has been impractical because it relies on suppliers voluntarily disclosing their own supplier networks — information most consider proprietary. AI is changing that equation through several approaches:

Network discovery through data fusion. AI platforms aggregate trade data, shipping records, customs declarations, corporate filings, and satellite imagery to infer supplier relationships without requiring voluntary disclosure. By cross-referencing bill-of-lading data with known factory locations and production capacities, these systems can build probabilistic maps of multi-tier networks.

Continuous risk scoring. Rather than point-in-time assessments, AI monitors news feeds, regulatory databases, weather systems, financial indicators, and social media in real time. When a Tier 3 supplier shows signs of financial distress or faces a natural disaster, the system can trace the impact upstream to your direct supply within minutes.

Automated compliance documentation. For CSDDD and similar regulations, AI generates the audit trails and impact assessments required for due diligence reporting, pulling from the continuously updated network map rather than requiring manual data collection from each supplier tier.

Gartner predicts that by 2026, over 50% of large enterprises will have invested in real-time supply chain visibility platforms — up dramatically from just a few years ago.

Building a Practical Sub-Tier Visibility Program

For companies starting their sub-tier mapping journey, the path forward involves four phases:

Phase 1: Critical path identification. Not every product line needs Tier 4 visibility. Start by mapping the components and materials where disruption would cause the greatest financial or operational impact. Focus resources where risk concentration is highest.

Phase 2: Data collection and integration. Combine supplier self-disclosure (still valuable for Tier 1–2) with external data sources for deeper tiers. Integrate procurement data, logistics records, and third-party intelligence into a unified platform.

Phase 3: Continuous monitoring deployment. Move from static annual assessments to real-time monitoring. This is where TMS and supply chain management platforms play a critical role — connecting logistics execution data with upstream supplier intelligence.

Phase 4: Regulatory compliance automation. Build the documentation and reporting workflows required for CSDDD and emerging regulations before enforcement begins. Retroactive compliance is exponentially more expensive than proactive preparation.

Turning Visibility Into Competitive Advantage

Companies that invest in sub-tier mapping aren't just managing risk — they're building a strategic asset. Full network visibility enables better negotiation leverage, faster alternative sourcing during disruptions, and the ability to make credible sustainability claims backed by actual data rather than supplier questionnaires.

CXTMS provides the logistics intelligence layer that connects supply chain visibility with execution. By integrating supplier management, shipment tracking, and compliance documentation into a single platform, CXTMS helps companies build the operational foundation that multi-tier visibility requires — turning upstream transparency into downstream performance.

Ready to map your supply chain beyond Tier 1? Contact CXTMS for a demo of our supplier visibility and risk management capabilities.