The FMCSA $2 Million Insurance Mandate: What the Proposed Liability Increase Means for Carriers and Shippers

The federal minimum liability insurance for interstate trucking has been stuck at $750,000 since 1980. That number hasn't moved in over four decades — through inflation, population growth, rising medical costs, and an explosion in nuclear jury verdicts that now regularly exceed $10 million. The FMCSA is finally catching up, with a Notice of Proposed Rulemaking expected by May 2026 that would raise the minimum to $2 million or more.

For an industry already grappling with tight margins, this isn't just a regulatory footnote — it's a seismic shift that will reshape carrier economics, consolidation trends, and ultimately what shippers pay for freight.

Why the $750K Minimum Is a Relic

The Motor Carrier Act of 1980 established the current $750,000 minimum liability coverage requirement for trucks over 10,001 pounds hauling non-hazardous general freight interstate. Adjusted for inflation, that $750,000 would need to be roughly $2.8 million today just to maintain the same purchasing power.

Meanwhile, the trucking accident landscape has transformed. According to the Truck Safety Coalition, large truck crashes killed 5,837 people in 2022 alone — a 50% increase from a decade earlier. Medical costs have skyrocketed, and so-called "nuclear verdicts" — jury awards exceeding $10 million — have become increasingly common in trucking litigation. The gap between what carriers are required to carry and what accidents actually cost has become a chasm.

The FMCSA itself has acknowledged this disconnect. In recent proceedings, the agency noted that insurers have been reluctant to disclose the true costs of truck crash claims, making it difficult to set evidence-based minimums. But the direction is clear: the current floor is dangerously inadequate.

What the Proposed Rule Would Change

The FMCSA expects to issue its NPRM by May 2026, proposing minimum liability limits of $2 million or more for general freight carriers. While the final number may shift during the comment period, industry analysts widely expect the new floor to land between $2 million and $5 million.

Key elements likely in the proposal:

- Higher liability floors for all interstate motor carriers, not just hazmat haulers

- Phased implementation to give carriers time to adjust (likely 18–24 months)

- Possible tiered structure based on fleet size, cargo type, or operating radius

- Updated financial responsibility requirements for freight brokers, which already saw changes effective January 2026

The rule would apply to roughly 500,000 active interstate carriers registered with the FMCSA, with the most acute impact on the smallest operators.

The Cost Impact on Carriers and Owner-Operators

Today, owner-operators with independent authority pay between $9,000 and $17,000 per year for commercial truck insurance at the $1 million liability level that most brokers already require, according to AtoB's 2026 insurance cost analysis. A full insurance package — liability, cargo, physical damage, and bobtail — runs $900 to $1,800+ per month.

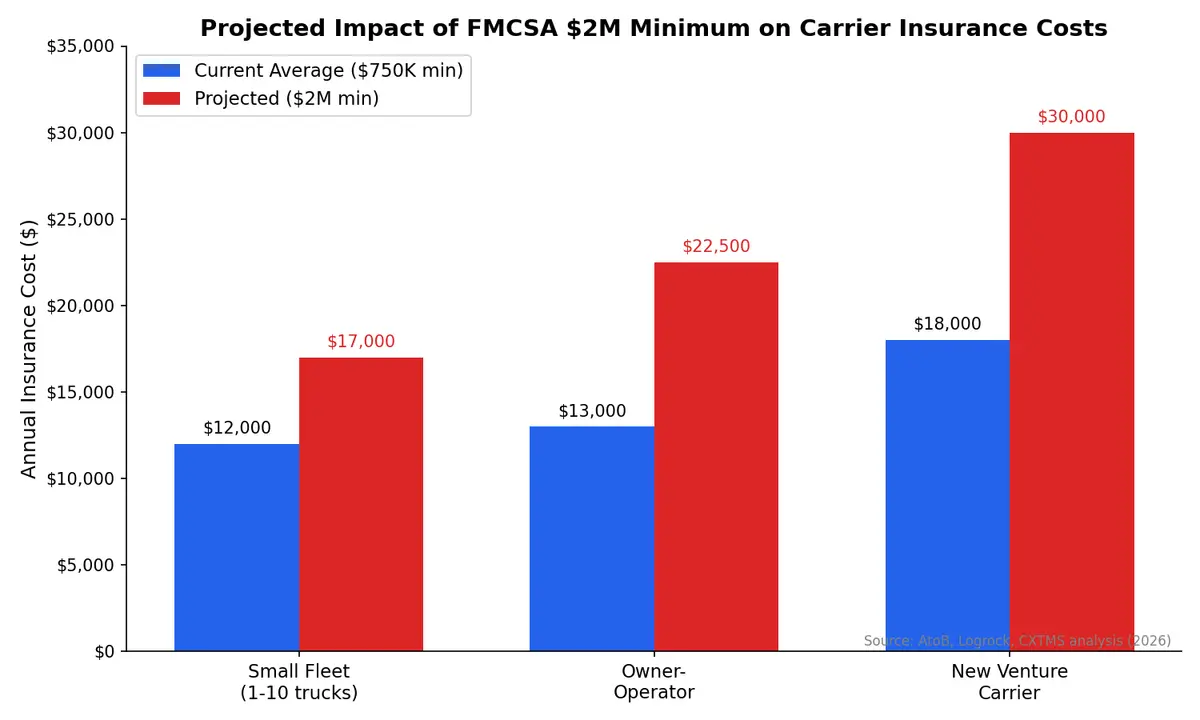

Raising the minimum to $2 million would push premiums significantly higher. Industry estimates suggest:

- Small fleets (1–10 trucks): Premium increases of 20–40%, adding $3,000–$7,000 per truck annually

- Owner-operators: Could see total insurance costs exceed $20,000–$25,000 per year

- New ventures: Already paying the highest rates, new-authority carriers may face premiums that make independent operation economically unviable

For context, insurance already represents one of the top three operating costs for trucking companies, alongside fuel and driver wages. A 30% increase in insurance costs on a single truck earning $180,000–$220,000 per year in revenue is the difference between profitability and shutting down.

The Consolidation Accelerator

This is where the macro story gets interesting. The U.S. trucking industry is dominated by small operators — over 90% of carriers operate 10 or fewer trucks. These are the operators least able to absorb a sudden jump in fixed costs.

Higher insurance minimums will almost certainly accelerate consolidation. Small carriers who can't afford the new premiums will either:

- Exit the market entirely, reducing available capacity

- Lease onto larger carriers who can spread insurance costs across bigger fleets

- Merge or sell to mid-size operators seeking scale

For shippers, this means fewer independent carriers to negotiate with and potentially tighter capacity in certain lanes — particularly regional and rural routes where small operators dominate.

What Shippers Should Expect

The cost increase won't stay contained to carriers. Higher insurance premiums will flow through to freight rates, likely adding 2–5% to linehaul costs industry-wide. Specific impacts for shippers include:

- Rate increases on new contract bids, particularly from small and mid-size carriers

- Tighter carrier vetting as brokers and shippers scrutinize insurance compliance more closely

- Capacity shifts as marginal operators exit, potentially creating spot market volatility

- Longer lead times for carrier onboarding as insurance procurement becomes more complex

Smart shippers are already preparing by diversifying their carrier base, locking in longer-term contracts, and investing in compliance monitoring tools that can verify insurance status in real time.

How to Prepare Now

Whether you're a carrier or a shipper, waiting for the final rule is a losing strategy. Here's what to do today:

For carriers:

- Review current coverage levels and get quotes at the $2M threshold now

- Invest in safety technology (dash cams, ELD compliance, driver training) to lower your risk profile and premiums

- Build cash reserves to absorb the transition period

- Consider group insurance programs through carrier associations

For shippers and brokers:

- Audit your carrier base for current insurance levels — how many are at the bare minimum?

- Model the rate impact of a 20–40% carrier insurance increase on your freight spend

- Strengthen carrier vetting workflows to catch lapses before they become liability exposure

- Use TMS-integrated compliance tools that automatically verify insurance certificates and flag expirations

Staying Ahead with Automated Compliance

The carriers and shippers who thrive through this regulatory shift will be those with real-time visibility into compliance status. CXTMS provides automated carrier vetting, insurance certificate tracking, and compliance monitoring — ensuring you're never caught off guard by a lapsed policy or a non-compliant carrier in your network.

When the FMCSA finalizes the new minimums, the transition window will be tight. The time to build your compliance infrastructure is now, not after the rule drops.

Need to strengthen your carrier compliance and vetting workflows? Contact CXTMS for a demo of our automated compliance management platform.